It’s “ISA season” this month, which finishes on 5th April when this tax year ends.

It’s “ISA season” this month, which finishes on 5th April when this tax year ends.

There are just two requirements to becoming an ISA millionaire and they are:

Discipline. You must ensure you use your annual ISA allowance religiously if you can, as it’s a “use it or lose it” allowance.

Process. You need a clear idea of how you will select funds with the greatest potential, and that process must have a proven track record of success, and be one which you can simply apply year after year.

It doesn’t matter how disciplined you are about making your ISA contribution if you don’t have a repeatable process to identify winning funds. The problem with most approaches is that they are profitable only with the benefit of hindsight, and so aren’t repeatable or useful for an investor.

In contrast, if you identify funds with momentum, you are using a process which has a distinguished track record going back over two centuries.

This Is How It Works

A simple example. Today you buy the fund which was the top performer over the last 6 months, taking into account all sectors – this is the fund which has momentum. Then in 6 months you repeat the process – you sell the fund you hold and buy the top-performing fund of the most recent 6 months.

That’s it, and this particular approach is what sits behind our Bonkers 6-Month portfolio. This is Momentum-style investing at its purest and simplest.

A Terrible Time To Invest? 2000?

2000 was the first full calendar year you could have made an ISA investment. It was also the start of the end for an extraordinary bull market, and the first of three consecutive calendar years of double-digit declines for both the FTSE 100 and S&P 500.

We have been through some extremely turbulent times starting from that period. A lost decade topped and tailed by the Technology Crash and the Global Financial Crisis in 2008, a Covid Flash Crash in 2020, and a war and global cost of living crisis. So this is an “interesting” period over which to test our Bonkers approach.

Using the Momentum process explained above, you would have begun in 2000 by investing into JPM Global Financials and would currently hold BlackRock BGF World Energy, (based on our March/September cycle for the Bonkers Portfolio). In the interim you would have invested in all manner of countries and sectors. South Korea in early 2002, China in late 2007, Biotech in late 2013, UK Small Caps in late 2021, anything that was generating the best growth and had momentum, is where your money went.

The results are VERY impressive.

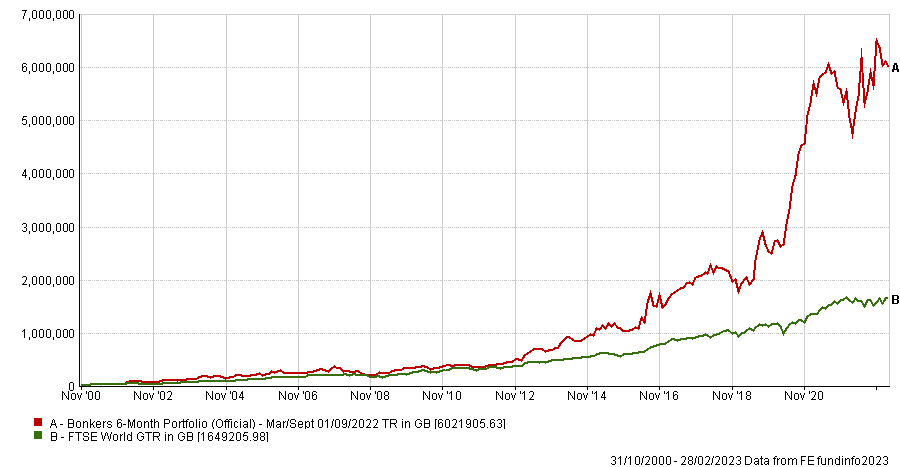

Now imagine you made the current maximum ISA contribution at the start of each year since October 31st 2000. This is shown in Chart 1 below, Bonkers (red) versus FTSE World (green).

The value of your investments into the Bonkers Portfolio would today be worth 3.7x that of the FTSE World.

You would have made an extra £4,372,700 compared to the index.

It should go without saying but, be wary of those peddling trackers or passives linked to such indices, they could cost you millions!

Oh yes, and of course our performance numbers are after all fund charges.

Chart 1

● Saving Date: 1st of the Year ● Regular Annual Investment: £20,000 ● Total Savings: £480,000

Of course the Bonkers Portfolio is a little, well, bonkers. Would you have around £6m invested into just one fund?

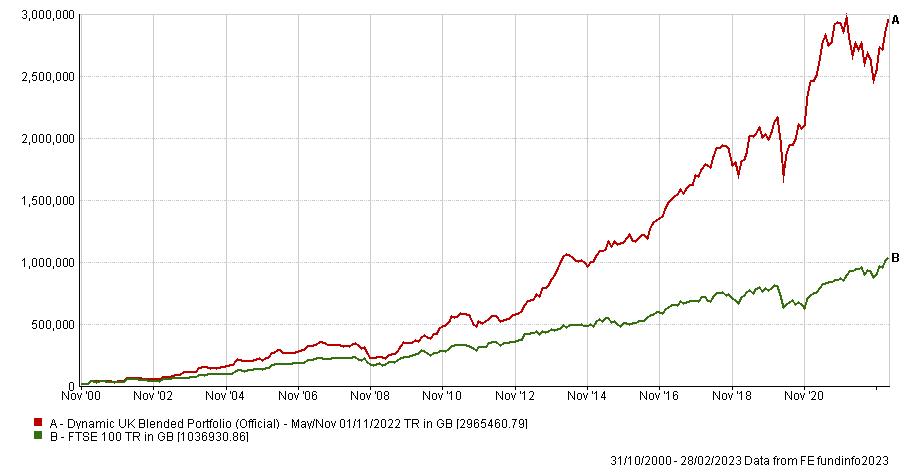

To regain some sanity, let’s see how this Momentum-style approach to selecting funds would have worked with our flagship Dynamic UK Blended Portfolio, the red line in Chart 2 below. Bear in mind that this is a fairly conservative portfolio, centred on the UK stock market, and made up of three UK investment funds at any one time, funds invested into many household names.

We compare this portfolio with the FTSE 100 index (green) in Chart 2.

The value of your investments into the Dynamic UK Blended Portfolio would today be worth 2.9x that of the FTSE 100.

You would have made an extra £1,928,530 compared to the index.

With both of these examples of a Momentum-style portfolio, do remember that these results are being achieved in an era fraught with crises.

Chart 2

● Saving Date: 1st of the Year ● Regular Annual Investment: £20,000 ● Total Savings: £480,000

You Can Become An ISA Millionaire

If these returns were repeated going forward, again investing £20,000 per annum, you would have £1m in 14 years with both the Bonkers portfolio and the Dynamic UK Blended Portfolio. The FTSE World would’ve got you there after 18 years, and the FTSE 100 after 22.

Still not convinced?

The Pedigree For Momentum

This track record of success and extra growth has been confirmed through extensive long-term research by FundExpert, for many fund sectors, analysing over 200 overlapping 5 year rolling periods (more here).

George Soros is the most famous (and successful!) exponent. Early research dates from 1937. There are hundreds, perhaps thousands, of academic papers on Momentum-style investing. Nearly all confirm it continues to work, though most still struggle to explain why it works at all. It is so simple to apply it almost insults the intelligence.

One relatively recent paper was by the famous academic trio of Dimson, Marsh and Staunton of London Business School, who are authors of the indispensable Credit Suisse Global Investment Returns Yearbook. They put the doubters to bed in their 2008 paper “108 Years of Momentum Profits”, which analysed over a century of UK stock market data (plus another 16 countries).

They concluded:

“There is extensive evidence, across time and markets, that momentum profits have been large and pervasive”

“We now know that momentum has in fact been a feature of the market for a very long time... it has been remarkably persistent”

If investors can apply their process with discipline, then they have the potential to achieve the sort of outstanding results set out above. As David Ryan, winner of the US Investing Championship in 1985 with a Momentum strategy said:

“The more disciplined you can get, the better you are going to do”

There is more on this in Brian Dennehy’s best-selling book “Clueless”.