With the winners at Chelsea Flower Show settled this week, let’s figure if your portfolio might have won any prizes.

A beautiful but low maintenance garden might require little more than pruning and tidying twice a year. A straightforward plan.

A more complex, but stunning, display will require more time but still have been built around a clear plan.

If the judges looked at your portfolio, would they see parallels with the latter two? Or not?

You might look at your garden and see something “interesting and wild”, but others will see it as a mess which needs a lot of time and money spent on it.

Similarly, your investments. You might smile and call it eclectic – but the reality might be that it has no structure and is hugely underperforming over longer periods.

A portfolio can also be low maintenance, yet still be high performance. We have illustrated many times that a simple process applied twice yearly for 30 minutes can hugely improve performance.

You may opt to keep your garden portfolio maintenance as easy as possible, perhaps you are strapped for time and simplicity is key. For your investments, this may come in the form of our Dynamic UK Blended Portfolio.

For example, using a Momentum approach to select winning funds with this Dynamic Portfolio, it has grown by 1,513.42% since May 2000. In contrast, the FTSE 100 index is up just 175.91%. That is 8 times more growth! Imagine if you could do that with your pension fund… That’s life changing.

Chart 1: Dynamic UK Blended Portfolio vs FTSE 100 (from May 2000, total return, after charges)

Conversely, you may want to take a bit more risk with your flowers funds, by making a bold statement. Eclectic, but at least it is built around a plan.

That’s our Dynamic Bonkers 6-Month Portfolio. You’re never quite sure what might appear with this strategy, and you do need to make sure you maintain tight discipline, and quickly cutting away any nasty weeds apply a Stop-Loss.

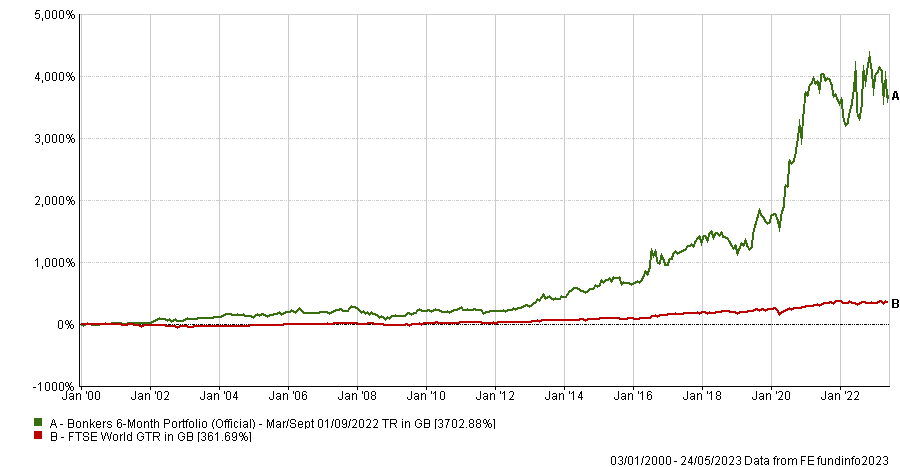

Again looking back to the period since 2000, the growth was 3,702.88%, compared to FTSE World of just 361.69%. That is 10 times more growth!

Chart 2: Dynamic Bonkers 6-Month vs FTSE World (from Jan 2000, total return, after charges)

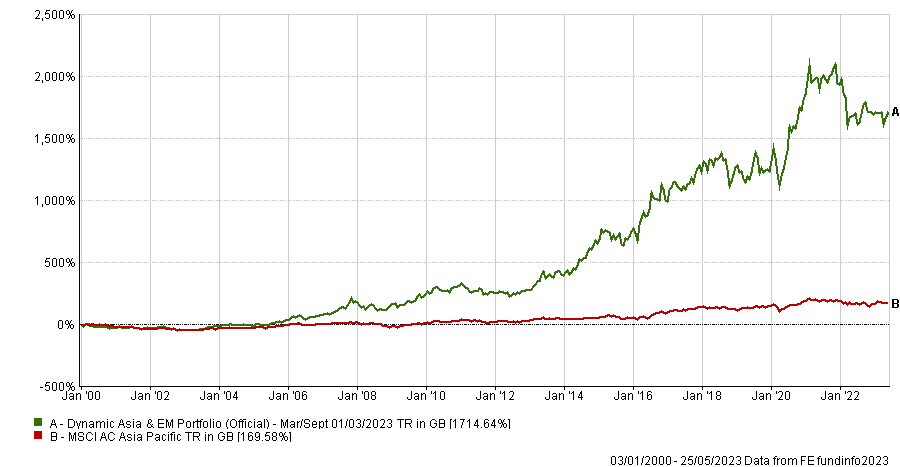

The final approach is about putting down seeds for longer-term blooms, sourced from more exotic locations. This is what you can achieve with our Dynamic Asia & Emerging Markets Portfolio, as you can see in char3 below. In this case the returns since 2000 are again 10 times the index – impressive.

Chart 3: Dynamic Asia & Em. Mkts vs MSCI Asia Pac. (from Jan 2000, total return, after charges)

A great garden and a consistently outperforming portfolio have one thing in common – a thoughtful plan, consistently applied.

Of course, no garden or portfolio is protected in extreme conditions*. There will be some damage. But as the storm clouds move away, the prize-winning gardener has a plan – he knows what works, and what doesn’t.

Most investment portfolios have also encountered some damage over the last year or so, an undoubtedly frustrating period. But the better investors know what works when the clouds begin to clear, they know the evidence of the above charts. They have a plan. And plans win prizes.

*P.S. Out of interest, if you look at the top right of all three charts, you can see that the last couple of years have been very volatile. But these charts enable you to quickly gain a longer time perspective. The volatility of recent times barely touches the longer term performance. Once this current period of uncertainty resolves itself, that prior trend will re-assert itself.