Here we look at some historical trends, and finish with the most powerful type of trend which can drive your investing success.

Here we look at some historical trends, and finish with the most powerful type of trend which can drive your investing success.

Some trends are long, others short. Some positive for your investing success, others not.

Going Nowhere For 3,000 Years

Sometimes a trend can not just be very long, but also very dull.

We talk about investing in the stock market as being a way in which you can make money by piggy-backing the hard work and ingenuity of human kind.

Yet all the way up until 1750, for nearly 3,000 years, economic growth averaged only 0.01% per year. In other words, global living standards were essentially flat. (Source: Bank Of England).

The lesson is, don’t assume someone else’s ingenuity will always make you rich!

Warning From History – Inflation Trends

Periods of high inflation trends can also be very prolonged. It is reckoned that a standard basket of goods didn’t change in price from 1275 to 1500. Then inflation took off unexpectedly. From 1525 to 1650 the price of a loaf of bread went up by 400-700%.

By the 1590s Europe was “consumed by financial crises, social unrest and war… society and politics became radically unstable” (The Economist). Massacres, revolts and wars were commonplace, as were debt crises and defaults. The period culminated with Charles 1 of England losing his head.

Bubble Lessons

Of course, an uptrend in financial markets does not start as a bubble, but grows into one, as a period of cautious optimism morphs into over-confidence not justified by company profits – thus creating a valuation bubble.

Prior to 2020, the most modern example of an extreme valuation bubble is the one which peaked in Japan on 31st December 1989. Today, their stock market remains 32% below that 1989 peak, and at worst was down 82%.

More Positive Trends

We talk about a 40 year trend just ending, and how investors need to take great care, and forget what worked in the last 40 years, because the next 40 years will be different. Of course there was a huge positive hidden in that uptrend – it secured the financial well-being of many who are today in their 80s and 90s. We cannot assume we will be so lucky - we must remain vigilant as a new cycle unfolds.

The focus of the bursting bubble today is the US stock market, and other financial markets around the globe, will not be completely unscathed as the US goes through a painful re-balancing over years.

Nonetheless, positive trends were observable in 2022 even as the US bubble suffered its early death throes.

In the first chart below, you can see how commodities performed, the obvious winner of 2022, in this case in the guise of JPM Natural Resources. It was up 35% at best, in contrast with the US stock market, which was down 20%. With the world needing re-building (think Victorian sewers) and greening, the demand for commodities will be booming for many years to come.

Chart 1 - JPM Natural Resources in 2022

The 2nd chart is Value-style Japanese smaller companies, another area we have highlighted for years, from 2009 onwards.

The Value-style is what typically works in an environment of rising inflation and higher interest rates. This M&G Japan Smaller Companies fund was up 8% over the year, versus the Japanese stock market down 12%.

Chart 2 - M&G Japan Smaller Companies 2022

Japan also ticks other boxes. It is cheap, it will benefit from China re-opening, and UK-based investors will get a boost from a strengthening yen.

Shorter Trends - Momentum

A few decades ago it was noticed that what went up in financial markets tended to keep going up. Not forever, but within certain timescales.

Extremely detailed research followed in the years afterwards, by both academics and practitioners, all of which re-confirmed this trend. The result is what is called Momentum investing.

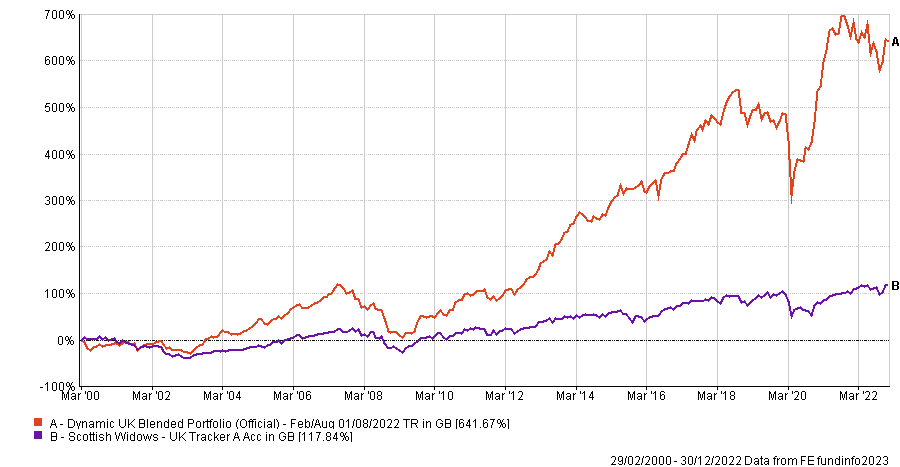

In 2005 our own research in a similar vein focussed on funds. Applying just such a Momentum-style, as shown in chart 3 you can see the massive extra growth generated by our Dynamic UK Blended Portfolio - essentially a portfolio of funds invested into UK stock market.

Chart 3: Dynamic UK Blended Portfolio versus Index Tracker (2000-2022)

Since January 2000, a terrible time to start investing, it has gone up 774%, versus 168% for the FTSE 100 index.

This Momentum style of investing exploits a very powerful type of trend, and is at the heart of the portfolios within our new Discretionary Fund Management service (DFM). If you haven’t already had details of this, please do ask.

Dexterity Essential!

The years ahead will have ups and downs which cannot easily be anticipated - it is the type of environment in which no one working today has experience.

That being so, using this Momentum-style will be vital to objectively identify profitable trends, as markets ebb and flow.

Dexterity, a willingness to alter your investment choices, will be essential. In contrast, an approach which might have worked in the last 40 years, such as “buy and hold”, will cost you dearly.