One of the ironies of no-risk or low-risk funds is that we have to be much more careful in our analysis. If something goes wrong, the risks are considerable. Here I look at cash funds, a bigger issue than normal in recent times as interest rates have gone up, and more investors have larger sums on deposit.

One of the ironies of no-risk or low-risk funds is that we have to be much more careful in our analysis. If something goes wrong, the risks are considerable. Here I look at cash funds, a bigger issue than normal in recent times as interest rates have gone up, and more investors have larger sums on deposit.

Earlier this year our sister company, Dennehy Wealth, moved from platform cash to cash funds with our discretionary portfolios. Why?

- The interest rates are typically better, approx. 3.5% vs 1-3%, depending on your platform and product. (This has become a bit of a moving target with rates moving fast, and some platforms trying to catch up)

- You are diversified across about 50 odd separate bank holdings.

To us the key risk issue is not the guarantee on deposit monies (up to £85,000 per bank or building society). Our view is that in extremis the government and financial authorities will have to guarantee all deposits. This is what happened in 2007 with Northern Rock, and in recent weeks with Silicon Valley Bank in the US. The reasons why this is vital are also included in this blog updating on the recent banking crisis.

The key risk issue is the nature of the underlying holdings. Cash funds are more diversified than platform cash, but you must be careful.

For example, in 2010 Standard Life were fined for misleading customers about the safety of a “cash fund” which blew up in 2008. It invested in a number of bonds which “plummeted in value”. This one also went to the High Court, where I was a witness, and the claim was in excess of £110m.

If we were talking about an equity fund, I certainly wouldn’t be trawling through the reports and accounts of that fund, reviewing every holding. You know the nature of the risk you have bought into with an equity fund. But there is often not the same clarity with a cash fund, or something whose name sounds very much like a cash fund (which was part of the Standard Life problem).

In terms of unit trusts/OEICS, there are two sectors;

- Short-term money market retail

- Money market retail

They contain four and five funds respectively, which makes the analysis easier. Take particular care if you are considering what appears to be, or sounds like, a cash fund within your SIPP or investment bond. Similarly, if you come across a unit trust or OEIC fund which sounds like a cash fund, steer clear of it unless it is in one of these two sectors, and, as you will see, the short-term money market sector in particular.

In this blog I focus on the above two sectors.

These two sectors sound very much the same, and you might be tempted to buy the fund with the highest yield across these two sectors. First warning – cash funds with the highest yields are typically taking a bit more risk in some shape or form. Second warning – these sectors are surprisingly very different.

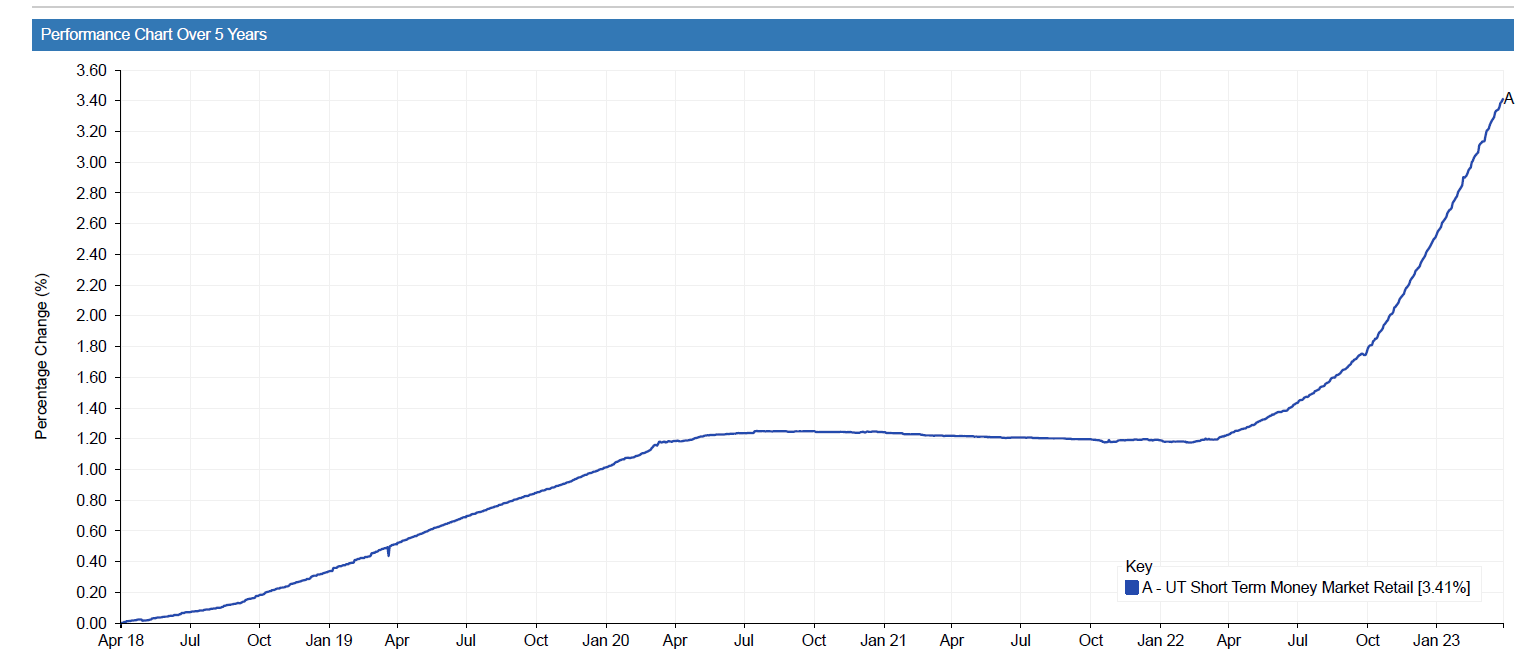

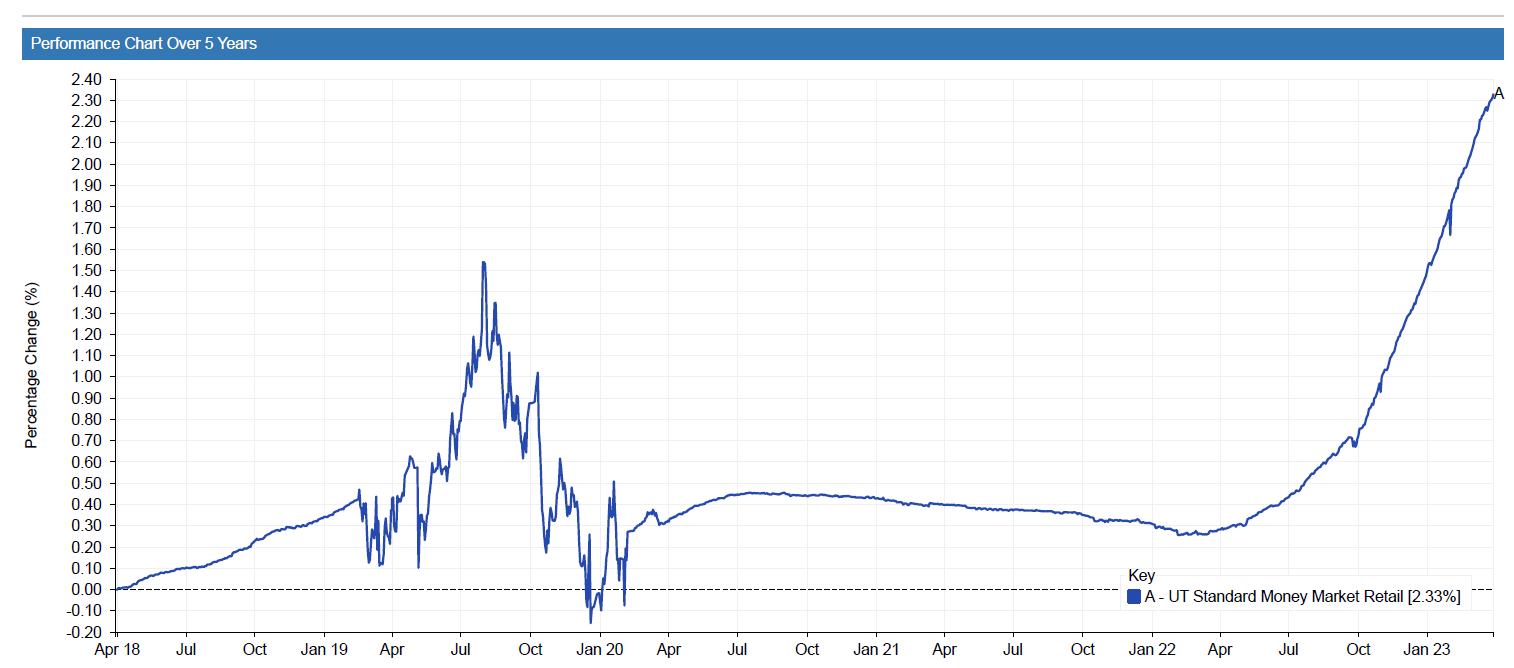

In chart 1 below you can see the performance of the short-term money market sector over the last 5 years. It could not be clearer that there is no volatility, a nice smooth line, as you would expect. Chart 2 is a different kettle of fish, as you can see quite extreme (relative) volatility in the period 2019-2020.

Chart 1: Short-Term Money Market Retail, total return last 5 years

Chart 2: Money Market Retail, total return last 5 years

From these charts it is reasonably clear that you should only be considering the four funds in the short-term money market sector.

We focused our attention on Legal & General and Fidelity cash funds, which had been our invariable choices since 2007, and with which we had never had any problems. Nonetheless, the events of recent weeks raised another issue which required double-checking – bank bonds. Even if one of these funds held very short-dated bank bonds, typically with little or no volatility, it wouldn’t matter if one weekend the bank got into trouble, and was closed down by the authorities with total losses on all the bonds issued by that bank. This is what happened with SVB and Credit Suisse over the last month.

The Fidelity fund appeared to have a small bank exposure, whereas the Legal & General fund had none. You can see the complete report and accounts for the latter by clicking here, with a complete breakdown of the underlying deposits on pages 5 and 6.

On these cash funds I would recommend that you do not rely on third-party analysis of the fund, including high-level splits between assets held by the fund. You should seek out the report and accounts for the fund issued by the fund group itself. You can always find these on their website or by a google search.

In conclusion, take care with cash funds by taking into account the above simple steps, and not chasing higher yields. The focus above is the Legal & General fund. This is not a specific fund recommendation, and you must satisfy yourself on your choice. On the other hand, you should be able to choose any one of the four funds in the Short-Term Money Market sector and sleep well at night.