Last time (Investing Under 30s – Unlocking Your Potential) I looked at how to give you a realistic opportunity of funding a gap year in your 30s. That included demonstrating the power of compounding when investing your monies, and introducing a process for selecting funds: Dynamic Fund Ratings. This week I focus on the remarkable evidence for this process – it’s Bonkers!

Last time (Investing Under 30s – Unlocking Your Potential) I looked at how to give you a realistic opportunity of funding a gap year in your 30s. That included demonstrating the power of compounding when investing your monies, and introducing a process for selecting funds: Dynamic Fund Ratings. This week I focus on the remarkable evidence for this process – it’s Bonkers!

I explained last time (Investing Under 30s – Unlocking Your Potential) why investing in the stock market, in particular stock market funds, is a great way to make your money work harder. When doing so, there are four proven methods you can follow to outperform stock market indices, detailed here.

In simple terms, one of those is to buy what is cheap without good reason – what is called Value investing.

Another approach is to buy “winners” – this is Momentum investing, and the evidence for its extraordinary success sits behind our Dynamic Fund Ratings (you can see more on the evidence here).

If you are investing lump sums, we advocate using our Dynamic Fund Ratings to build a portfolio based on a spread of funds based on your attitude to risk – all very sensible.

But if you are young, you have a very long time to invest, and the view of many (including myself) is that you should take as much risk as possible. I will return to what “risk” means in this context – for example, “can I lose all of my money?” is always a pertinent question!

But first, let’s take a look at what we call our Dynamic Bonkers Portfolio.

What Is “Bonkers”?

There are thousands of different types of funds, and they sit in a myriad of sectors e.g. one for UK stock market funds, one for China, and one for more exotic funds (“Specialist”) which might include anything from gold to India, and so on – thousands in total.

This is the Dynamic Bonkers Portfolio formula:

- We bundle all of those thousands of funds together…

- …. then look back over the prior 6 months to identify the top-performing funds.

- We invest into that fund for the next 6 months.

- 6 months later we repeat the process, replacing the winner from 6 months prior.

Our own very detailed research, stretching back over decades, and that of many others, confirms that this 6-month period is optimum.

We call it “Dynamic” because every 6 months you are proactively switching into the latest winning fund.

That’s it.

But it does mean that you can swing from zany gold for one 6-month period, then to sensible government bonds in the next, and then followed by an incomprehensive Artificial Intelligence fund. The key is discipline – don’t try and out-think the selection – just buy it. Why? Because…

The Growth Is Bonkers Too!

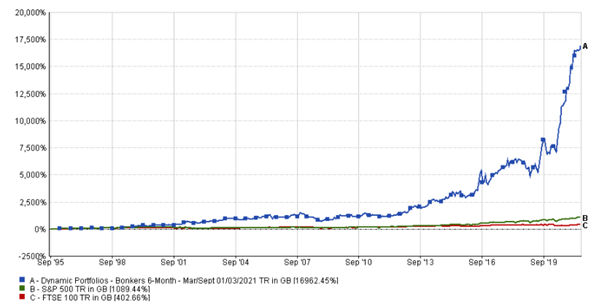

The Bonkers Portfolio grew 42x more than the UK stock market from 1995 to date. 42x more growth!

In case you think this is because the UK market was poor over that period, it also grew 15x more than the US stock market, which has been booming in recent years.

You can see this crazy difference in chart 1 below. Nearly 17,500% growth versus, on this graph scale, not very much.

Chart 1

Planning For A Gap Year? Consider Bonkers:

Last time we calculated that with “just” 8% growth in your money every year, in 10 years you would have accumulated enough to pay for a gap year – actually an amount equivalent to two whole years net salary! £36,457.

Not bad. But this could be hugely better.

With the Bonkers Portfolio, it would have been £88,942 in 10 years. That is based on an annualised growth rate of 22% (Table 1).

And over 20 years it achieved more than 7x as much! So, an 8% growth rate is very good – but Bonkers is, well… bonkers!

Table 1

|

Years

|

Bonkers

|

8% growth

|

|

10

|

£88,942

|

£36,457

|

|

20

|

£874,043

|

£114,732

|

|

Since 1995

|

£3,089,345

|

£206,692

|

(This assumes investing £200 per month growing based on either the annualised Bonkers performance of 22% or an assumed 8% annualised growth rate, both compounding monthly)

Risky?

Strictly speaking, the risk is the likelihood of you losing everything. In this case, as you are invested in funds, you are inherently diversified e.g. a typical stock market fund might invest into 40-80 different companies.

So, when we talk about risk here it is really about the ups and downs in the value from day to day – which is strictly speaking volatility.

To consider this in a meaningful way we look for the worst months and worst years since 1995.

For our Bonkers Portfolio, these figures are marginally higher compared to the UK and US indices, as you can see below.

So that’s 15x and 42x the return of the S&P 500 and FTSE 100 respectively, with only a tad more risk, or volatility.

That falls into the “no brainer” category of decision-making.

Table 2

|

Portfolio/Index

|

Worst Month %

|

Worst Year %

|

|

Bonkers

|

-19.9

|

-36.1

|

|

S&P 500

|

-16.4

|

-29.9

|

|

FTSE 100

|

-13.4

|

-28.3

|

Data from 01/09/1995 to 14/06/2021

Get Started Now

If you are under 30, you might not want all of the bells and whistles of our FundExpert Gold Membership.

Our experience is that you would like someone to chat with and ask some questions, and then they set it up with you.

If that sounds like you, we have set up this service for under-30s in our advisory arm – email Tara.Dennehy@dennehywealth.co.uk, and begin that conversation – it is very straightforward.

Alternatively, if you do want to do all of this yourself, our Gold Membership gives you everything you need to get going with your own Bonkers Portfolio, assuming you already have an online investing account with someone.