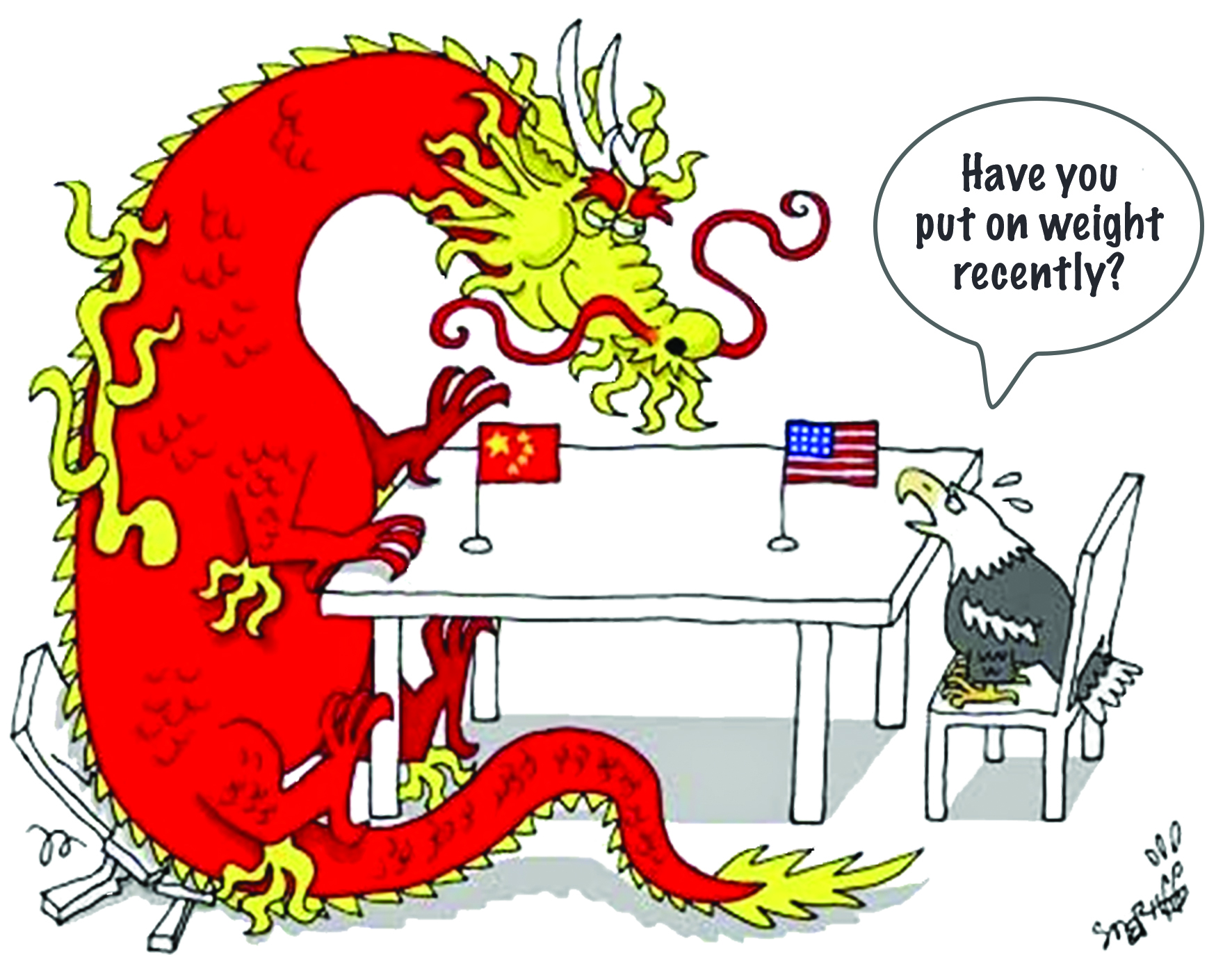

This is not any old trap. It is a trap derived from a stand-off between the two great powers of our time, which will be the most significant global back-drop to our investing for decades to come, up there with climate change. As an investor you don’t need to choose sides in any political or emotional way – but you will need to ensure you are fleet of foot to be a beneficiary, and not a victim.

This is not any old trap. It is a trap derived from a stand-off between the two great powers of our time, which will be the most significant global back-drop to our investing for decades to come, up there with climate change. As an investor you don’t need to choose sides in any political or emotional way – but you will need to ensure you are fleet of foot to be a beneficiary, and not a victim.

The possible outcomes are very polarised – extraordinarily positive for mankind, or horribly destructive. I explore these today.

In the last couple of years there have been some skirmishes, the one over Huawei being notable and reaching into the UK. We covered that previously here. As we head into 2021 it is Taiwan that is the most talked about source of friction, with the risk of conflict not negligible. In fact, history informs us that the risk of large-scale conflict is very high – but I will come back to that. For now, let’s focus on Taiwan.

In years past we have talked about the “Made In China 2025” project. The idea was that by that date China would become 70% self-sufficient in key areas of technology, such as electric cars and robotics.

It is semi-conductors, or chips, which are the big issue.

Those little chips drive everything. From factory robots to satellites, iPhones to missiles, laptops to electric cars. The US controls 47% of the global market for these chips, and that gives them extraordinary reach and power. These companies also employ 200,000 Americans.

China accounts for 60% of the demand for these chips – this gives the US significant leverage.

Although China, Taiwan and Korea now produce 30% of global chips, compared to just 20% a decade ago, China itself is about a decade behind in producing the most advanced chips.

It is Taiwan which has the clear advantage, not just over China, but also over the US.

This was emphasised last Summer when Taiwan Semiconductor (TSMC) announced it was making strides in leading-edge chips, while Intel, the US leader, announced production problems. At a company level, global leadership in semiconductors passed to TSMC, and Taiwan.

Taiwan now produces the greatest volume of the most important and advanced chips – as Saudi Arabia was for decades with oil, Taiwan is today for the world’s most valuable commodity.

This is what makes Taiwan the world’s most worrying potential flash-point.

China recently announced a new $29 billion project to develop their own chip industry in years to come. Rather than slow China, Trump’s belligerence has served to inspire them to bigger, better, and faster progress.

But if China spends a decade trying to catch-up and achieve its desired self-sufficiency in chips (the target is now 2035), that is a decade when China will feel exposed, despite its massive progress and leadership in so many other areas.

What History Says – It’s All Greek

If the headline for this blog had been “The Thucydides Trap” you might have thought “Brian’s off down a rabbit hole again, I’ll skip to the next blog”. So if you have got this far, do read on – this is a very big issue.

If China and the US find a way to co-exist as global powers, and as technology leaders in particular, the decades ahead could see extraordinary advances for mankind. But history is not obviously on their side.

The ancient Athenian historian and military general Thucydides said “it was the rise of Athens and the fear that this instilled in Sparta that made war inevitable”, and this led to the hugely destructive Peloponnesian War.

This fear, of an existing great power being displaced by an emerging power, has a tendency to lead to such extreme conflicts. This is “The Trap”.

Back in 2012 American political scientist Graham Allisson put this trap in the context of the modern rivalry between the US and China. In particular he and colleagues at Harvard reviewed 16 similar instances going back over 500 years, and in 12 instances this rivalry led to war.

One was Germany challenging Britain a century ago. Once Germany achieved naval supremacy this was incompatible with the existence of the British Empire, which, hitherto, had ruled the waves. German conduct was not the problem – after all the Kaiser told Theodore Roosevelt in 1910 that war between Britain and Germany was simply unthinkable, and “I adore England!”.

But the Kaisers adoration was not enough. It was German capability, not their conduct, which was the problem – the rising capability of Germany as measured by its growing naval fleet.

It becomes dangerous when a rising power rivals a ruling power – as Athens challenged Sparta in ancient Greece, or as Germany did Britain a century ago.

That growing capability of the challenger creates the vulnerability to a destructive war. An ordinarily containable crisis, such as the assassination of Archduke Ferdinand, has a completely disproportionate outcome.

There is a very clear parallel with the way in which we analysed markets in recent years, pre-pandemic. The extreme valuations and levels, and poor quality of debt have created a vulnerability to a shock which ordinarily, might be perfectly manageable – but not so now.

Each of the 16 cases studied by Allison are, of course, unique. Debate still rages about the causes of the First World War (much as it does about every financial crisis, from 1929 to 2008).

But Thucydides and Allison point us to the powerful common feature – the new capability of the challenger naturally creates fear and paranoia in the other – that is abundantly clear in the US today.

Can China and the United States escape a similar destructive outcome?

In the four instances where all-out war was avoided, it required huge adjustments in attitudes and actions on the part not just of the challenger, but also the challenged.

On the one hand you have “the rising power’s growing entitlement, sense of its importance, and demand for greater say and sway”.

On the other hand, the established power is driven by “fear, insecurity and determination to defend the status quo”.

Will the US share with China the dominance in the Western Pacific that it has enjoyed since World War II? If not, Taiwan may literally be the battleground.

As the rising power grows so too does “its self-confidence, its consciousness of past injustices, its sensitivity to instances of disrespect.”

China believes a century of Chinese weakness led to exploitation and humiliation by Western colonialists and Japan.

In contrast, Sparta United States interprets the Athenian Chinese posture as unreasonable, ungrateful, and threatening to the system Sparta the United States has established.

Will China follow the path of Japan and Germany and take its place as a reasonable stakeholder in the international order that America has built over the past seven decades?

No. China does not want to be an honorary member of the West.

The problem for the West is that never before in history has a nation risen so far, so fast, on so many levels.

In one sense, if the world did not have China, it would have to invent it.

The financial shock of 2008 caused all other major economies to decline. In contrast, China never missed a year of growth. Indeed, since 2009 nearly 40 percent of all growth in the global economy has occurred in China. Today, China has displaced the United States as the world’s largest economy, and the future looks bright.

The world must find a new balance where China is at the top of the top table alongside the US. Nothing less can work.

Back to Graham Allisson:

“The rise of a 5,000 year old civilization with 1.3 billion people is not a problem to be fixed. It is a condition - a chronic condition that will have to be managed over a generation.

Managing this relationship without war will demand sustained attention. It will entail a depth of mutual understanding.

Most significantly, it will mean more radical changes in attitudes and actions, by leaders and publics alike.”

Investment Conclusion

President Biden’s approach will at the very least create the opportunity for a world where not only do US and China co-exist, but perhaps also co-operate for the huge benefit of mankind. Biden is already surrounding himself with experienced and insightful people, the sort who understand how much can be achieved with diplomacy and containment, not the conflict encouraged at every turn by the idiot Trump.

The First World War offers a sobering reminder of man’s capacity for folly if the US, in particular, gets this wrong.

For now, you must make space for China in your portfolio. Next week we will look in more detail at the funds.

FURTHER READING