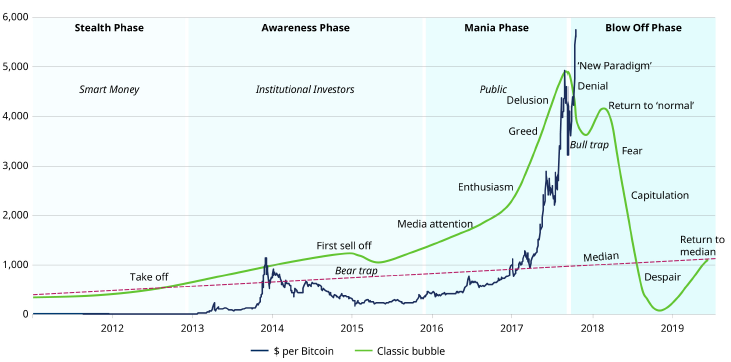

Schroders have produced much insightful research over the years. Here they look at a chart comparing bitcoin’s price movements with a classic market bubble. This should be enough to test the ‘leap of faith’ currently being taken by the herds of investors entering the cryptocurrency market.

Schroders have produced much insightful research over the years. Here they look at a chart comparing bitcoin’s price movements with a classic market bubble. This should be enough to test the ‘leap of faith’ currently being taken by the herds of investors entering the cryptocurrency market.

“Proper excited about Mobile Cryptocurrency! I’m in, get involved!” (Source: Twitter, 20 October 2017). So tweeted Harry Redknapp last week about a ‘mobile cryptocurrency’ called electroneum.

On reading it, we could not help but think of the song famously associated with one of the serial football manager’s former clubs, West Ham United. All together now: “I’m forever blowing bubbles …”

Back in June, in Mouth-watering prospect or eye-watering valuation? [external link], we suggested investor behaviour surrounding bitcoin and other cryptocurrencies had a distinctly bubbly feel.

We pointed out how, from an early peak of $1,100 (£835) in late 2013, the value of a single bitcoin had lurched its way to within touching distance of the $3,000 mark and then raised the possibility its bubble may have burst.

Fast forward four months to last Saturday and one bitcoin would have got you a little over $5,800 before retreating below $5,600 a few days later, which neatly illustrates two points.

First, things move very quickly in cryptocurrency world – who knows where the price will be when you actually read this? – and, second, this is why we do not go in for market timing, here on The Value Perspective.

Still, regardless of whether bitcoin actually turns out to have been a bubble, its behaviour in recent years is a freakishly good impression of one.

Take a look at the following chart, which plots its price movements over the last six years against the classic trajectory of any asset bubble.

It is a pretty good fit, with the journey over the last few months putting bitcoin above the ‘New Paradigm’ point of the ‘Blow-off’ phase.

Is Bitcoin heading into a bubble?

Source: Thomson Reuters Datastream, 19 October 2017. Past performance is not a guide to future performance and may not be repeated.

To be clear, none of this is to attack bitcoin, the other cryptocurrencies or the extraordinary ‘distribution ledger technology’ that underpins them.

What we do find extremely concerning, however, here on The Value Perspective, is the behaviour of the wider market towards something whose intrinsic value cannot be assessed – for the simple reason it does not have any.

Crytocurrencies have no value to assess

As we wrote in June: “If cryptocurrencies were stocks, investors might at least have a chance of getting to grips with their balance sheets and working out what they were really worth but, as it stands, there is simply no metaphorical bonnet to open up and check underneath.”

The only real point of comparison for bitcoin, ethereum, Harry Redknapp’s top tip and all the rest are, in fact, traditional currencies.

But then, as we also pointed out: “Every money system is a man-made construct that is dependant for its very existence on an act of faith.” And, once again, we are humming that tune and especially its last verse:

“I'm forever blowing bubbles, pretty bubbles in the air,

They fly so high, nearly reach the sky, then like my dreams they fade and die.

Fortune's always hiding, I've looked everywhere,

I'm forever blowing bubbles, Pretty bubbles in the air.”

For more from the Value Perspective, you can follow them on Twitter here.