Japan has typically been one of the cheapest stock markets in the developed world for a number of years and has tended to be overlooked by Western investors.

Japan has typically been one of the cheapest stock markets in the developed world for a number of years and has tended to be overlooked by Western investors.

But not by us (catch up on our recent blogs here and here). As well as our regular commentary on Japan, we also have our Dynamic Japan portfolio which has consistently excellent results, and is up for review next month.

This blog is the first of a two-part series dedicated to Japan, with today’s piece a more high-level overview of the “Land of the rising sun”. Next week’s will be more investment focussed.

Setting The Scene

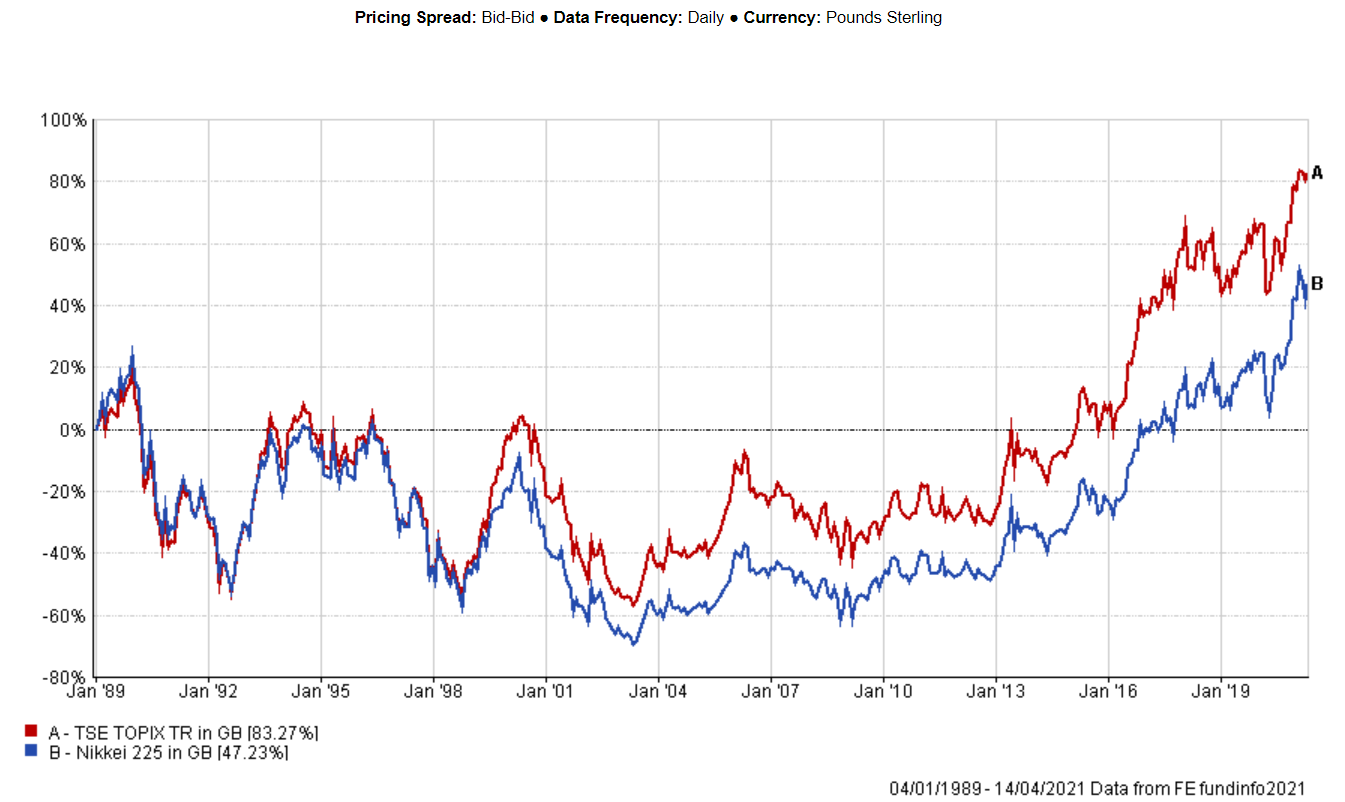

In recent months alone the two major Japanese stock markets have hit impressive highs; the Nikkei hitting 30,000 and the more representative Topix exceeding 2,000. See Figure 1 below for some context.

Fig.1 – Japan’s indices hitting all-time highs

Additionally, Japan has a significant manufacturing base, naturally putting themselves in a strong position for the global economic recovery over the next 12-24 months. Currently 60% of Japanese corporate profits come from export sectors. Taking Toyota for example, over 33% of their vehicle sales come from North America and the Far East. As global consumption continues to bounce, Japan’s exporters will reap the rewards.

So, it does beg the question, why are us Westerners still ignoring the Japanese market?

Well let’s begin with the three big trends that are shaping Japan’s socio-economic landscape.

1 – Population Decline

Japan’s population is falling by a staggering 400,000+ each year, while most of Europe and the rest of the developing world have populations that are still slowly rising. Perhaps more worrying is the rate of decline within the labour force, between 2000 and 2018 Japan’s labour force declined by over 11 million people.

2 – Ageing Population

The cause of our first trend above, and seen as the big red flag to international investors, is Japan’s ageing population. 28% of Japan’s population is over 65. For comparison, 17% of the UK’s population is over 65 and for the US and China this is 16% and 11% respectively. By 2050 this number is expected to hit 38% of the total Japanese population. However, we’re not totally convinced this is a bad thing, as we explain later on.

3 – Environmental Change

Japan has typically lacked natural resources (see here for a visual representation – external link) and therefore relies heavily on importing these. The main concern here is that a potential inflationary environment, as a result of the global economic recovery, would push prices of these imports upwards, directly hitting the pockets of Japanese companies. For example, copper future prices have doubled since March 2020, and are already higher than the commodity boom in the mid-2000s.

The opportunity in an ageing population

Despite the obvious drawbacks that come with an ageing population (reduction in labour, rising healthcare costs, potentially higher taxes imposed on the working population), it certainly isn’t all doom and gloom.

Firstly, an ageing population opens new opportunities for domestic companies where they can subsequently take advantage, such as replacing traditionally labour-intensive jobs with automated processes. As mentioned above, Japan has never been able to compete in the natural resources sectors, so their development and innovation in technology is of huge importance. Having faced the inevitable challenges that come alongside their ageing population, Japanese companies have invested heavily in their technology and automation processes:

- 5 of the top 10 largest producers of factory components are Japanese. (1)

- According to the WEF’s 2019 Global Competitiveness Index, Japan ranked 6th out of 141 countries for business competitiveness, earning high scores for both technological savviness and innovation capability. (1)

- Daiwa House, Japan’s largest homebuilder, has allocated $6.2 billion towards the development of new logistics facilities incorporating automated transport and inventory robotics through 2022. (2)

A leading fund manager in Japan has recently echoed those thoughts:

“Although an ageing population could be considered detrimental to economic growth and productivity (all things being equal), sectors that tackle the issues head on can be a good hunting ground for sustainable investment returns. Automation and technology firms have been obvious beneficiaries, as companies seek to automate processes and replace labour-intensive functions with machines”.

What does the future hold?

Let’s talk about the elephant in the room, COVID. Some will point to the slow pace of the vaccine roll-out in Japan (just over 1% of the population is fully vaccinated) and suggest that this means Japan’s economic recovery will be slow. However, the effects of the pandemic in Japan were far less severe than in the West, lockdowns (referred to as “mockdowns”) have been very lenient.

Looking further ahead, Japan is still remarkably undervalued and underrepresented. In 1989 Japan accounted for 45% of the global stock markets (by market cap) while the US was at 33%. By 2017, the US represented 53% of global stock market capitalisation, with Japan sliding all the way down to just 8.4%. Moreover, since 2015 there have been heavy global investor outflows from Japan, but we are starting to see this pattern finally reversing.

In terms of valuations, Japan is still extremely cheap (even more so than the Eurozone!), despite corporate profits in Japan growing 180% since the late 1990s and Japan still occupying 3rd place in terms of the largest domestic market in the world.

Another specialist Japanese fund manager gave us their view on where they see the main drivers of Japanese growth in the near future:

“The performance of the market will be driven by a combination of internal factors (improving domestic economy, enhanced profitability and better corporate governance) and the global economic recovery, but I firmly believe that it is only a matter of time before the Nikkei index surpasses 38,915, its previous all-time high.”

PS – that previous high is from 1989!

The components for a strong Japanese recovery and growth story are there, and next week we will look in more detail around how you can identify the trends driving this Japanese growth. For example, will it be via small caps or ‘value’ style funds? We’ll also uncover why Japan was recently described as “literally a stock-pickers dream” by one of the biggest fund managers in the world.

(2) Daiwa House

FURTHER READING