Despite the dramatic headlines on geopolitical matters over the last week, financial markets have been relatively calm, down a touch, and new highs are looming.

Despite the dramatic headlines on geopolitical matters over the last week, financial markets have been relatively calm, down a touch, and new highs are looming.

For example, the S&P 500 appears to be set for an all-time high after a couple more sideways and downward wiggles. It is much the same for the main UK stock market index, the FTSE 100.

Gold also seems poised for a new peak, particularly if the threatened escalation of war in the near east comes to pass. That it has not spiked higher already illustrates that markets are quite calm, assuming a benign outcome to the new front which has opened between Israel and Iran, similarly with oil.

Of major equity only Japan and Brazil are up over the week, around 1%, with clear uptrends in place. Europe and Hong Kong are down the most, by 3%.

It is interesting that the UK showed a little relative strength compared to the rest of Europe, which might surprise you with the poor economic data, and an outlook which is no better. Yet it is precisely that poor outlook which underpinned the UK stock market, in particular driven by prospective interest rate cuts.

In the Global Investment Returns Yearbook 2024, old acquaintance Professor Elroy Dimson, and his colleagues, showed the majority of returns from stock markets are earned when interest rates are falling.

For example, US rates were falling 55% of the time (1914 to 2023), and the annualised return in these periods was 9.4%. It was only 3.6% when interest rates were trending up. The pattern is very similar for the UK.

Global investment institutions know this, and they know the UK is relatively cheap, so they will not be shot for increasing their UK allocation. Although the FTSE 100 will be the obvious target, this is substantially a global index, and it is the FTSE 250 which will provide a more effective exposure to the UK economy if it is to be buoyed by falling interest rates.

Doing some basic technical analysis, while the FTSE 100 is within reach of an all-time high, the FTSE 250 is nowhere close, the peak being back in 2021, 15% above current levels. If the prospective cut in rates is to do its magic, the FTSE 250 should not fall more than 4% below current levels, and 20,400 should be support.

Though we are all understandably preoccupied by ugly power politics in the Near East and Ukraine, as investors it is the butting of the global titans, US and China, which will have the greatest impact on investment returns for years to come. That being so I wanted to share with you two articles I have been reading in the last week.

But first here’s a reminder from a note last November on how these two are lined up. This was the conclusion of Ford’s CEO after he visited China in September:

“Executing to a Chinese standard is now going to be the most important Ford priority”

He clearly saw that the Chinese auto sector poses an existential threat to Ford (and also Tesla?).

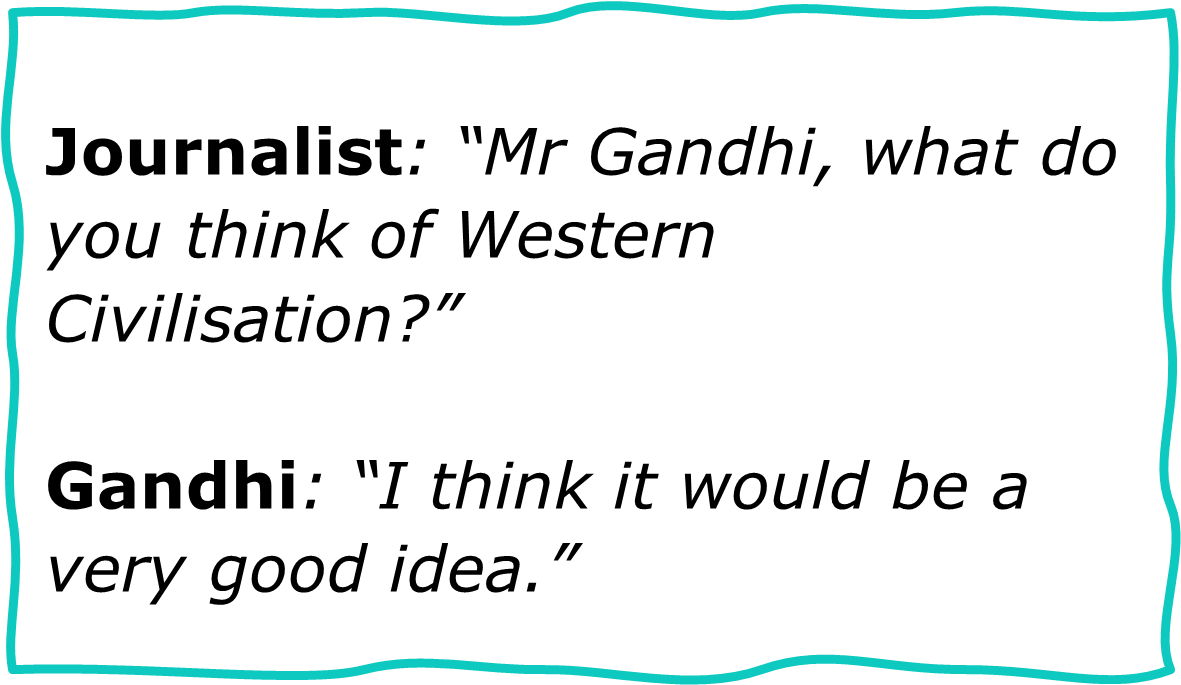

This Chinese dominance has arisen because the US, and other western nations, notably Germany, have simply not been paying attention. Why? As Louis-Vincent Gave put it:

“China leapfrogged the West in industry after industry over the last 5 years;

during that time no one bothered to visit China… while Western CEOs focussed on virtue signalling,

Chinese companies forged ahead, producing better products for less money.”

Ouch.

This kind of conflict has an ancient pedigree, as I covered in 2021, “The Trap – US versus China”:

“This is not any old trap.

It is a trap derived from a stand-off between the two great powers of our time,

which will be the most significant global back-drop to our investing for decades to come,

up there with climate change.”

This is The Thucydides Trap. The ancient Athenian historian and military general Thucydides said of the hugely destructive Peloponnesian War:

“It was the rise of Athens and the fear that this instilled in Sparta that made war inevitable.”

Similar instances have occurred throughout history, where the fear of an existing great power being displaced by an emerging power has a tendency to lead to extreme conflict - this is The Trap.

In 2012 American political scientist Graham Allisson reviewed 16 similar instances going back over 500 years, and in 12 cases this rivalry led to war. Of course each of these examples are unique. But Thucydides and Allison point us to the common feature – the new and growing capability of the challenger creates fear and paranoia in the other – that is abundantly clear in the US today.

Can China and the United States escape a destructive outcome? In the four instances where all-out war was avoided, it required huge adjustments in attitudes and actions on the part not just of the challenger, but also the challenged.

Do you sense any “huge adjustments”? No?

My reading in the last week highlighted the historical and cultural aspects of both countries, with consistency from one, and confusion the other.

“It is clear that China will soon be the most powerful nation in the world” proclaimed the headline. The revelation was that this appeared in The Telegraph, which tends to have a more “reds under the bed” tone. None of that from Stephen Davis, who illuminated readers with his discoveries travelling around China for a month.

The first thing that hit him was the “jaw dropping” infrastructure which has been built in the last 30 years, such as a brand-new railway network with trains running at a comfortable 200 miles an hour, sitting alongside a dense network of motorways.

The dramatic urban development is the next big thing which hit him, distinctive high-rise and high-density housing, with clusters fenced off into individual gated communities, interspersed with green spaces. The communities are spotlessly clean and there was a “great sense of orderliness”. Although the police are highly visible, this is more in a supporting role as there is a strong disapproval of antisocial conduct.

This chimes with the reassertion of older Chinese ways of thinking, including a revival of traditional religions, and Confucianism living happily inside a very modern country.

Stephen confirms that this is clearly an innovative, intensively competitive and forward looking society, underpinned by a powerful work ethic. Of course there are challenges and perhaps the greatest is the aging population. Yet artificial intelligence, AI, offers huge potential to assist aging populations, both in China and around the globe, and it can be no coincidence that China is rapidly moving ahead with AI solutions.

Last but not least, Stephen tells us “it was evident that there was a strong commitment to engage with the rest of the world”, in stark contrast to the journey the United States is pursuing under Donald Trump, which leads neatly to my other piece of reading this week.

The headline is “Isolationism is not a dirty word”. It sounds like it might be an apology for Donald Trump, but to be fair it is intended to help everyone understand that isolationism is in the DNA of the United States since the time of the founding fathers. It was written in September 2020 by a professor of International affairs from Georgetown University, Charles Kupchan.

For much of their history, Americans restricted the scope of their overseas ambition to international commerce, in fact in much the same way as China had done for more than 3000 years. Although the Americans trampled their way across their continent, they pushed no further than the Pacific coast. Instead of running the world, Americans ran away from it, in Charles’ words.

They stuck to the idea laid out by George Washington in 1796 that they should extend their commercial relations to foreign nations, but otherwise have as little political connection with them as possible. Washington also warned that overgrown military establishments are particularly hostile to liberty, and that involvement in big power politics would siphon funds from productive investment and lead to higher taxation, “both of which would weigh on the growth and prosperity of the nation”.

For those in the United States establishment who believed it was their destiny to save the world, it would have to do so through the power of example not far-flung adventures.

Cracks in this philosophy began to emerge with the Naval Act of 1890 when they began to expand their navy despite warnings that this would be more likely to lead them into war with foreign nations than preserve global peace.

Isolationism was in the forefront of political thinking again when Europe was dragged into the First World War, but that ended when German submarines began sinking American vessels in 1917.

Despite the “lofty idealism” of Woodrow Wilson after the war, with the idea that the US would fulfil its destiny to save the world through a new League of Nations, they again retreated into their shell just as a new trend of extremism began to take hold in Europe and the Far East. The absence of the US left the door open for a torrid 1930s.

It wasn’t until the Japanese attack on Pearl Harbor in 1941 that the Americans finally overcame their aversion to foreign entanglement, and took the lead in post-war reconstruction with a global network of institutions, from the United Nations to the World Bank

This period of “liberal internationalism”, and frequent foreign entanglements which seldom ended gloriously, endured from the 1940s right up to the President Obama. Then in 2017 something changed. Donald Trump. It all began to go a bit weird, my words not Charles.

No doubt in recent days you will have heard repeated Trump quotes over the last decade, about bringing troops home and not fighting other people’s wars, just as George Washington would counsel. In his first term Trump pledged to end the era in which “our politicians seem more interested in defending the borders of foreign countries than their own.”

Until the last week Trump had led the charge on isolationism. Charles argued against such “obstinate isolationism” in 2020, recommending intelligent debate, advocacy and example, none of which seems likely under Trump.

Then in one week Trump turned his back on his much-vaunted isolationism, in favour of overseas “adventures”. US intelligence has advised on various occasions in the last year that there is no evidence that Iran has decided to build a nuclear weapon. (Not so dis-similar to there being no evidence of WMDs in 2002/3 – nonetheless the US charged into Iraq on a wild goose chase, resulting in the deaths of more than 4,500 US soldiers and 200,000 Iraqi civilians.)

Despite these warnings from recent history, and Washingtons concerns on international entanglements, Trump appears to be being sucked into conflict with Iran. Last week Israel proclaimed Iran was rushing to produce a nuclear bomb. Evidence was lacking, but hey ho. Trump got on board, and in recent days has referred to himself and Israel as “we”.

Hopefully by the time you read this, wiser heads will have prevailed. But the chaos being sown by Trump, and the risks of another very bloody war, go to show that The Trap is very much operative.

So this is how China and the US face each other just now. One following the path it has pursued for most of the last 3,000 years, the other fundamentally confused and at odds with much of the world.

There will be no note next Friday, though myself and the team will try and get something out if events in markets run out of control – certainly possible.