As ever, if you have any questions about the below research please do not hesitate to contact us.

The new funds for each Dynamic Portfolio will be listed below, or alternatively you can view the new funds on the designated Portfolio Library page.

Performance Graphs will be over the review period unless stated otherwise.

The Dynamic Portfolio’s below are sorted A-Z.

Commentary

There are 2 Dynamic Portfolios to update this month

- Bonkers 6-Month Portfolio

- Dynamic Asia & EM Portfolio

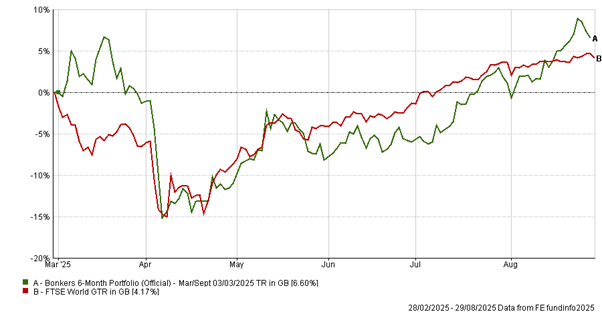

Bonkers 6-Month Portfolio

A favourite for many and living up to the name this month, starting off down 15% in April and ending 6.6% up, beating the FTSE World benchmark (up 4.17%).

This portfolio is now rotating out of China into gold miners, who had a storming 6 months.

- Since inception (Sep ’95) +22,024% vs FTSE World +1,263%

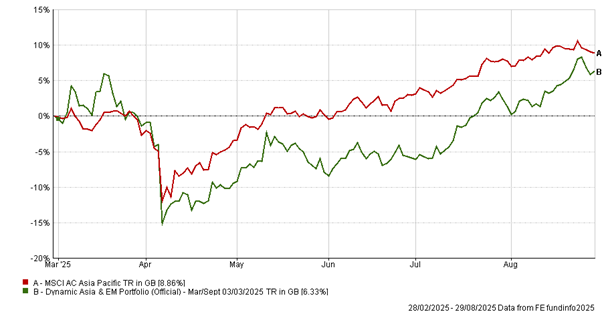

Dynamic Asia & EM Portfolio

Another period of two halves, kicking off with a 15% fall over the tariff liberation debacle and then recovering to finish up 6.33% vs the MSCI Asia Pacific +8.86%.

The three funds are moving away from China, into Korea and Japan.

- Since inception (Mar ’99) +8,093% vs MSCI Asia Pacific +453%

- Bonkers 6-Month Portfolio

-

6-Month Review

Bonkers 6-Month: up 6.60%

FTSE World: up 4.17%

Review Period Performance Chart

Performance Table

|

Name

|

6m

|

1yr

|

3yr

|

5yr

|

Since Inception

(Sep 95)

|

|

Bonkers 6-Month

|

6.60

|

15.97

|

27.12

|

77.80

|

22,024.06

|

|

FTSE World

|

4.17

|

14.13

|

43.49

|

83.79

|

1,262.91

|

Risk Table

|

Name

|

Worst Month

|

5 Year Volatility *

|

5-Year Monthly VaR**

|

|

Bonkers 6-Month

|

-19.85

|

21.06

|

-12.25

|

|

FTSE World

|

-15.99

|

11.67

|

-5.57

|

Review Table

- Dynamic Asia & EM Portfolio

-

6-Month Performance

Dynamic Asia & EM Portfolio: up 6.33%

MSCI Asia Pacific: up 8.86%

Review Period Performance Chart

Performance Table

|

Name

|

6m

|

1yr

|

3yr

|

5yr

|

Since Inception

(Mar 99)

|

|

Dynamic Asia & EM Portfolio

|

6.33

|

-7.80

|

26.74

|

61.56

|

8,092.59

|

|

MSCI Asia Pacific

|

8.86

|

13.36

|

24.84

|

34.11

|

452.97

|

Risk

|

Name

|

Worst Month

|

5 Year Volatility *

|

5-Year Monthly VaR**

|

|

Dynamic Asia & EM Portfolio

|

-18.67

|

12.76

|

-6.20

|

|

MSCI Asia Pacific

|

-12.41

|

11.00

|

-6.85

|

Review

*A measure of the size and frequency of short-term changes in the value of an investment.

**Monthly Value at Risk (VaR). A VaR of 6% means that in 19 months out of 20 you should not, on average, expect a fall in the capital value of more than 6% in any one month. The VaR of a typical UK stock market fund is 6%, for reference