Many investors think that all funds are more or less the same. This, of course, could not be further from the truth. While fund managers should aim high, some funds seem to consistently target poor performance. Here we look at some of those funds that are a warning to all investors!

There are many complex ways to assess fund performance but sometimes the simple ones are the most informative. Here we look at one of the most popular sectors – UK All Companies – and drill down to discrete 12 monthly investment periods over the last 10 years.

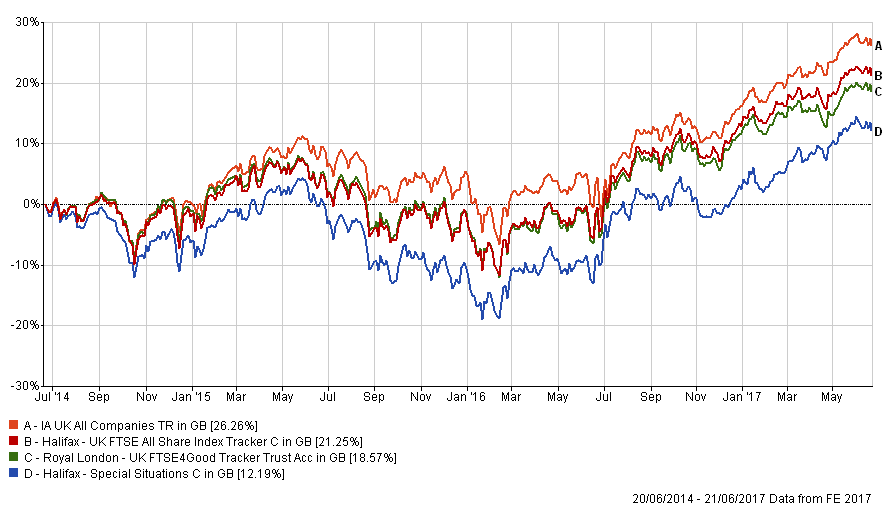

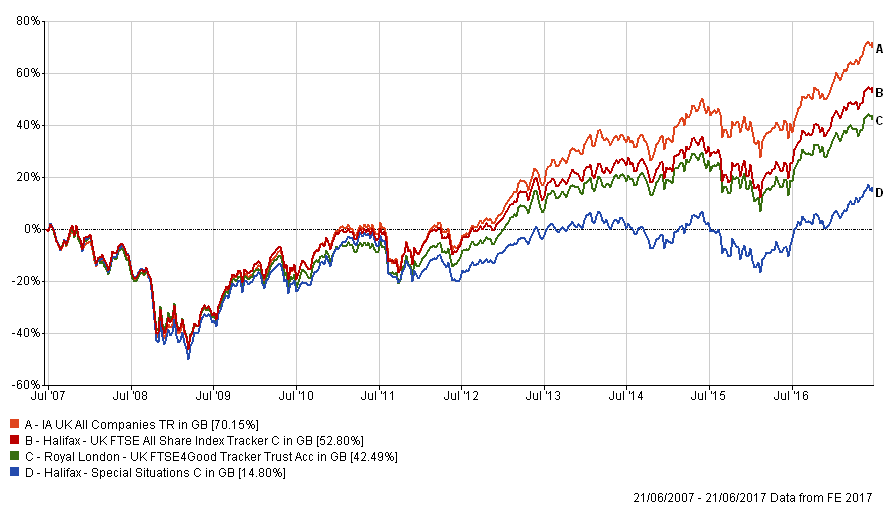

The funds that most frequently fall outside the top two quintiles (the top 40%) are ones to avoid. Here are some of the "best" examples (charts 1 & 2).

Halifax Special Situations (£150m) is unfortunately consistent – failing to make it into the top two quintiles 88% of the time (1). But the fact that it remains open begs the question: if you can keep performing badly but investors leave their money where it is then who is the greater fool?

What has always been particularly unpalatable about many of these high street bank branded funds is that they were probably sold to people largely ignorant of investment matters – they put their trust in Halifax and they have been badly let down. The fund should be closed.

Halifax UK FTSE All Share Index Tracker (£2,027m) is another poor Halifax fund, falling outside the top two quintiles 89% of the time. This “tracker” fund has spectacularly failed to track its index. Over 10 years, it is 18% behind the index it is supposed to be tracking but, incredibly, is still over £2bn in size!

Royal London UK FTSE4Good Tracker Trust (£141m) fell outside the top two quintiles 91% of the time.

This last fund raises the issue of ethics and profit. Many fund managers now apply an “ethical test” at some level during their investment process, so many investors benefit from this without being aware (although this isn’t universal). However, investors need to approach ethical investing with their eyes open. Many will buy an “ethical” fund for very good reasons. But a bit of thought may be needed. Are you really better off avoiding a less restricted fund if you're also missing out on better performance? That extra return could be used to directly benefit your chosen charities or causes. Something to think about.

Depending on your investment plan and goals, you might be better off, and be able to make more of a targeted social impact, if you invest in unrestricted funds.

So, what can you do?

There are really just two ingredients you need to escape the trap of poor performing funds:

- Process: have a method in place (such as Dynamic Fund Ratings) that enables you to select outstanding funds.

- Discipline: be sure you review and maintain your investment portfolio regularly (SIPP, ISA, pension etc.)

You need a clear idea of how you will maximise your returns – a process – and the discipline to apply it consistently, year after year.

ACTION FOR INVESTORS

- Don’t get stuck in poor performing funds

- If you think you’re stuck – take action. This could be reviewing your process (or setting one up!)

- The “ethical” label is important but you may be able to do more good by investing elsewhere

FURTHER READING

Table 1: 3-year performance chart

Table 2: 10-year performance chart

Notes

(1) This is based on our Vintage fund ratings. For those interested in the basis for calculation, to achieve a Vintage rating a fund must be in the top 40% of performers in 60% of the time. The “time” is the 120 overlapping 6 monthly periods in the last 10 years, with a higher weighting applied to more recent periods.