Do you hold commercial property funds? They might form the “boring” part of your portfolio but they might soon go through some interesting times. Here we look at the options for investors, clouds on the horizon, and what you should do if you hold (or are thinking of buying) commercial property funds.

If you hold, or are thinking of investing in a commercial property fund, you’ve probably come up against the Investment Trust (IT) vs. Unit Trust (UT) dilemma. Both have their merits but are very different animals. Which you buy depends on what you want.

What do you want?

Commercial property bricks-and-mortar within a unit trust is lower risk, while the shares of commercial property companies are a stock market investment, so would be medium risk. They are completely different asset classes.

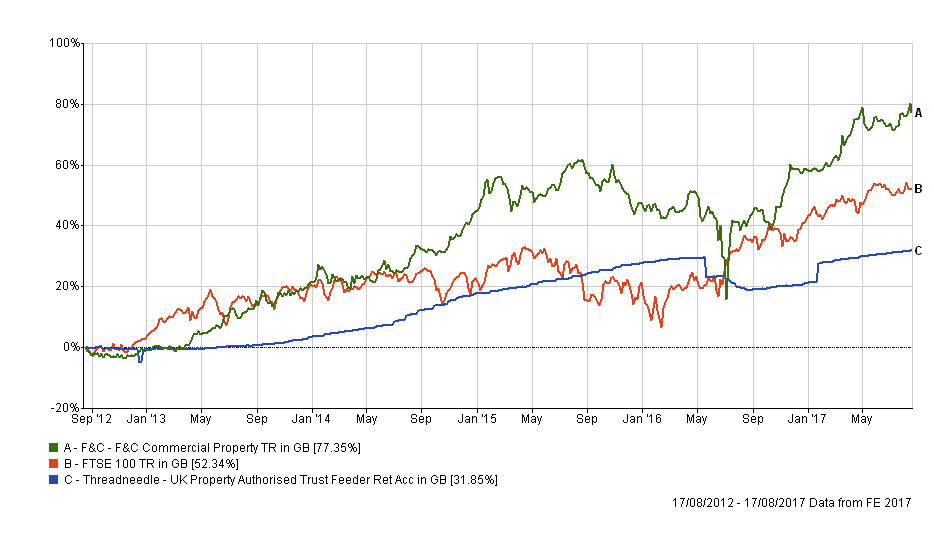

Investment trusts will behave more like stock market investments. If you are content to invest into bricks and mortar property via an investment trust – such as F&C Commercial Property – you’ll find it can be more volatile than the stock market as a whole.

For example, after the Brexit vote it is well publicized that some property unit trusts’ prices were “adjusted” downwards – by 6% in the case of Threadneedle UK Property (see chart 1). In contrast the F&C fund fell by more than 25% - be sure you are comfortable with this level of volatility.

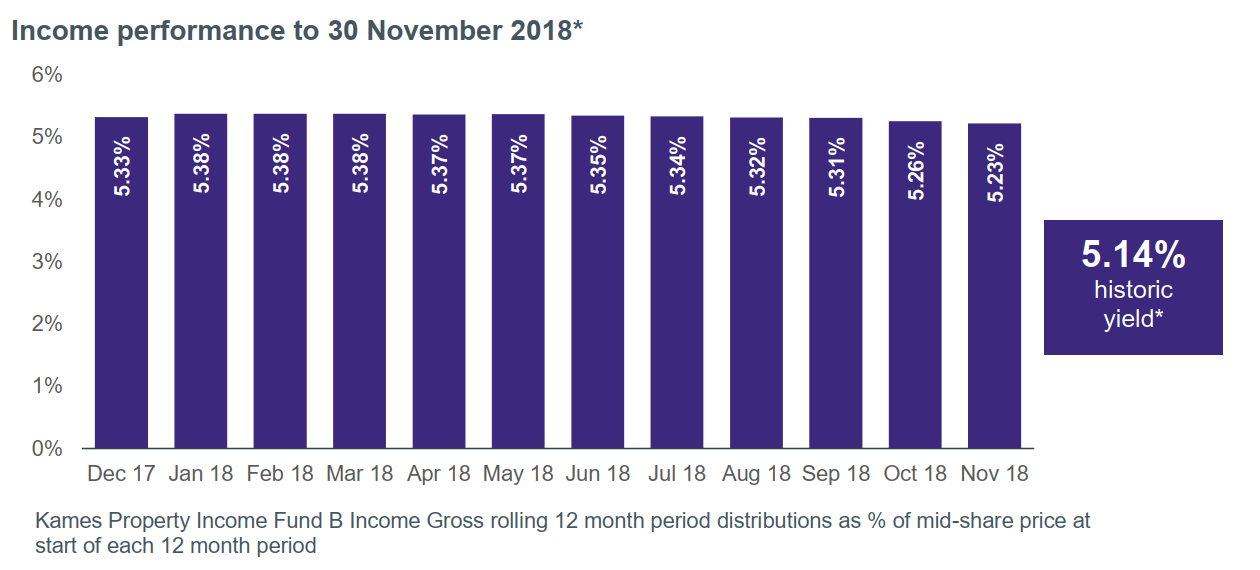

In the last few years, if you wanted a pretty stable capital value and reliable return a margin over deposit rates, bricks-and-mortar unit trusts like Threadneedle UK Property or Kames Property Income were a good option. Chart 2, extracted from the Kames Property Income fund’s November 2018, report shows the consistency of this particular fund.

Risks rising?

Property’s attractions haven’t gone unnoticed. Around the world, big investors, pension funds and sovereign wealth funds have been ploughing into property, pushing up prices

This has been particularly noticeable in the big urban centres like London, New York and Shanghai where companies like WeWork have been buying up prime property with big chunks of debt (see more on this

here).

As prices go up, the yields fall. It’s like a waterfall, as investors struggle to find returns they get pushed into riskier and riskier investments.

The FT recently reported on the growth of Collateralised Loan Obligations (CLOs) in the US, which it called the “riskier cousins of the more mainstream commercial mortgage backed securities”. These are coming to market at the fastest rate since 2009.

Remember it was in 2007/8 when mortgage-back products brought the global economy to its knees.

Buyer Seller Beware

The three main risks that we see are:

Firstly, there are growing risks of a global recession. Timing and size are always in doubt, but the warning signs are already in view.

Secondly, there are global concerns over high commercial property values, and this includes the UK. If there was a recession, valuers tend to overreact, meaning prices fall more than might be justified by conditions.

Thirdly, we might (I put it no more strongly!) be moving towards Brexit. That being the case this is likely to put the icing on the cake of the last two risks in the short term, whatever one’s personal views on Brexit.

Remember that any unit trust, particularly one invested in property, can suspend trading if prices fall sharply, so do take account of that possibility in your planning.

Depending on your views and investment timeframe you may decide that you are happy with the risks. That’s fine. It’s a decision you’ve made with your eyes open.

At this point we think it prudent to step to one side of such property funds, not make any new investments and switch out into cash.

Though cash is not ideal, it doesn’t fall in value in a recession or panic. But the latter will create cheap buying opportunities, when we can all look to reinvest cash advantageously.

ACTION FOR INVESTORS

- Commercial property funds have had a good run

- The risks are rising

- If you think you’re going to panic, panic early.

FURTHER READING

Chart 1: Property investment trusts, unit trusts and the FTSE 100 around the Brexit vote

Chart 2: Kames Property Income Fund – Income payouts from November 2018