We talk at length about how to select funds with a straightforward process, and thereby create the potential for outstanding growth. But what about periods when the markets go into a tailspin? You need to anticipate these, and think through how you will respond. Here we have a look at how you’d have done if you invested at (possibly) the worst time to invest: January 2000.

This was the top of an extraordinary bull market, on some measure the most extreme in 300-odd years. But the bubble was about to burst, tipping us into an ugly bear market.

We have previously considered how you would have performed from 2000 until recently* – it was obviously a difficult starting point but the extra returns were still superb over the years ahead*.

But what about during and just after that bear market? This is important because how you behave in response to such a challenging period is pivotal to the growth you achieve in the many years ahead.

Using our Dynamic Fund Ratings (more on that here) in January 2000, you would have invested into three funds:

- Artemis Capital

- Artemis UK Select

- AXA-Framlington UK Select Opportunities

Then in July 2000 you would have switched out of those funds into the best performing funds over the preceding 6 months…and so on.

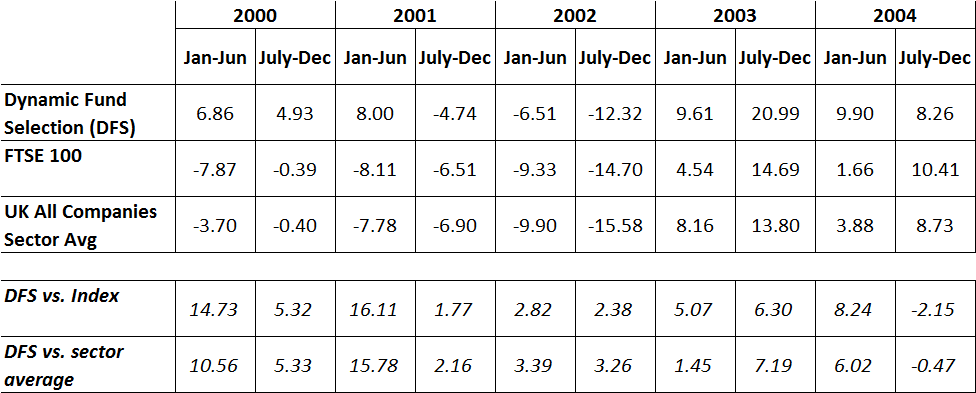

In the table below we show the performance of the Dynamic portfolio, the FTSE 100 (index) and the UK All Companies sector average. In the first 6 monthly period, Dynamic Fund Selection was up 6.86% compared to -7.87% for the index, a difference of 14.73%.

In all but one period (July-Dec 2004) Dynamic Fund Selection outperforms the Index and the sector average. And in that period Dynamic Fund Selection is still positive, it just doesn’t rise as much as the other two. That is a superb testimony to using our momentum-style ratings, Dynamic Fund Selection.

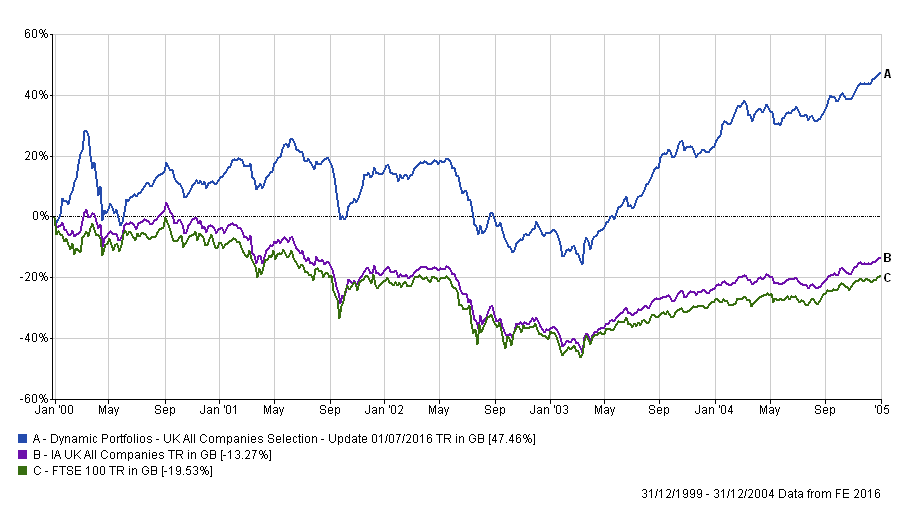

You can see from chart 1 that a portfolio selected using Dynamic Fund Selection outperforms the index and the sector average pretty consistently from the start in January 2000. There are some sharp peaks and troughs but by January 2004 the portfolio has broken above the March 2000 peak while the index was labouring along in negative territory compared with the starting point until January 2006.

"Everyone has a plan ‘til they get punched in the mouth" - Mike Tyson

Looking back, and even breaking down those 6 monthly periods, it wasn’t too bad was it? Yet our table and graph doesn’t bring out how investors felt at the time. Headlines were perpetually gloomy, and the instinctive reaction of nearly all of us (yes, you and I) is to abandon our plan in such circumstances, our process for buying funds – typical reactions are to sell out or stick our heads in the sand and pretend nothing is happening.

The whole point of a process is to navigate you through periods both thick and thin. And if you have done your homework on our process you know that most periods will be thick rather than thin – but you need discipline!

Even now (a much less stressful time for markets than 2000-2003) we observe two types of investor behaviour occurring when you should be applying Dynamic Fund Selection.

Firstly, after a very positive 6 months many retain the existing funds – after all they haven’t done badly, on the contrary. Discipline breaks down, the process isn’t applied, and once you get into the habit of not applying the process it becomes…well… a habit!

Secondly, after a less good 6 months the inclination is too often to get disheartened. Discipline breaks down, the process isn’t applied….etc.

In both cases your long term potential is lost. All that potential so vividly set out in The Mystery of the Missing £808,446 and elsewhere, week after week. And in the sector breakdowns here.

*Performance from 1 January 2000 – 14 Sept 2016. UK growth funds using Dynamic Fund Selection were up 395.66% - in contrast the FTSE 100 index was up just 71.91%, and the average UK fund 91.05%.

ACTION FOR INVESTORS

- Make sure that your process has strong evidence of success

- If you’re going through a rough patch, stick to your process and keep applying it with discipline

- If you’re lacking either a process or discipline, then start from the beginning

FURTHER READING

Chart 1: Dynamic Fund Selection compared with the FTSE 100 and the UK All Companies Sector Average