The invasion of Ukraine means scenario 2 in this analysis is operative. (updated 8th March 2022)

Over many years we have emphasised that it is not our job to be cheerleaders for the investment industry. Our job is, among other things, to bring to you realistic assessments of events which might impact your investments.

And we still try and do so with a smile…

We aired a teleconference for subscribers to our FundExpert service on Monday 21st February.

In anticipation of that teleconference a few days before we said:

“That there is a sweep of vulnerabilities [in the West] is well understood by Vladimir Putin. This means that now is a sweet-spot for Putin to fulfil his ambitions (though precisely what those might be remains unclear). As the decade progresses, key Western weaknesses will subside, particularly energy and supply chains. It feels like now or never for Putin.

On Monday, we will attempt to unravel this rich vein of vulnerabilities and cross-currents.”

Obviously unaware of what Putin had in store on Monday evening, on Monday lunchtime our teleconference began, before moving on to Putin specific issues, by reiterating the vulnerability of markets at this dangerous time. In particular the investment mania and bubble in the US, and a mountain of horribly low-quality debt around the world.

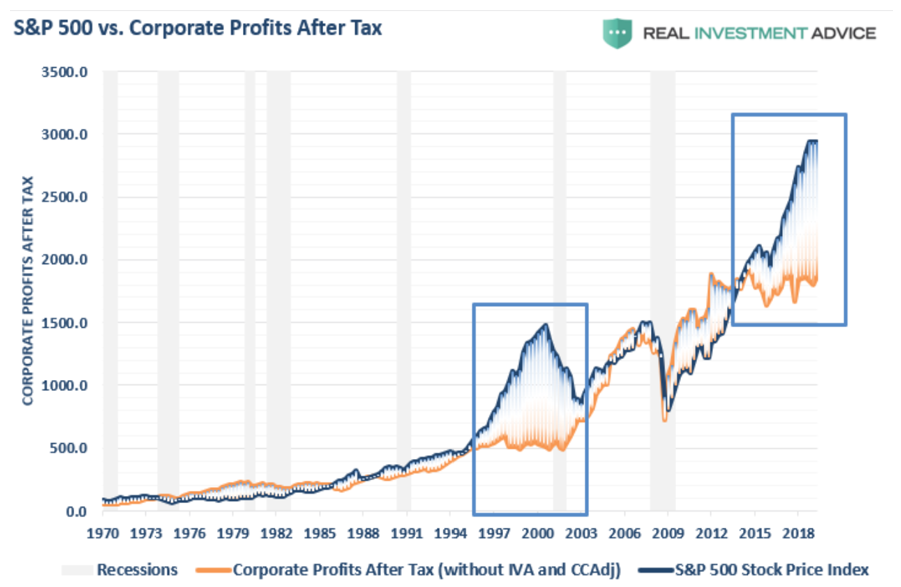

In this graph you can see how the US stock market took off in 2009 (blue line), while the profitability of US companies drifted sideways (orange line). What drove their stock market higher was not growing profits, but rather the persistent error of the US central bank (and others) in keeping emergency interest rates in place for a decade after the fire went out.

This error pumped up a huge, and dangerous, bubble of over-valuation.

In addition to that bubble, there is an investor mania, and the two together create a unique vulnerability.

A mania is all about extreme investor behaviour, and the foundation for a mania typically builds over many years, in particular changing how many people think about risk. In the case of today’s mania, the foundation was laid by 40 years of falling interest rates. Although built over years, a bubble can go pop overnight.

Record debt has been taken out to invest in the US stock market (what is called margin debt).

Why? Because there’s a mania.

The amount of that margin debt as a proportion of the US economy has never been greater. When the markets fall sharply the investments have to be sold in a panic to repay the debt, driving markets down even further.

Margin debt is always a problem at market peaks, as over-confidence spills over into mania and obsession, just as it did in 2000/3 and 2007/9 and 1987 – when the US stock market fell more than 20% in one day.

It is a much bigger problem today than it was on those prior occasions.

This mania isn’t just about the stock market.

“There’s a crazy number of gambling and sports betting adverts on TV ” observed one commentator in the US.

Why? Because there is a mania.

This Vox.com headline catches the role of technology in the problem:

“The internet turned “money” into a hobby”

That hobby bubble is vulnerable to a shock, as Peter Atwater puts it:

Normally we do not spend too much time trying to understand and analyse possible shocks – after all, there is always something to worry about and most do not turn into “shocks”. But the immediate mix of cross-currents, combined with unfolding events in Ukraine, require a more detailed treatment.

Remember, history informs us that the combination of “just” an investment bubble and mania suggests falls in excess of 50% in the pivotal US stock market.

Today there is much more going on than just that combination of bubble and mania.

In addition to the latter, there are multiple crises, all of which interact.

- War crises

- Inflation crisis

- Supply chain crisis

- Energy crisis

WAR CRISES

How does history inform us? Not much.

They never occur in a vacuum and are defined by the nations; location; timing; length; public support; and the economic and political context.

First World War: 28th July 1914; US market dropped 30%; market closed; upset delicate balance of global trade.

Second World War: booming US market through much of the period as US manufacturing switched to a war footing.

Even in 1914, supply chains were a global issue.

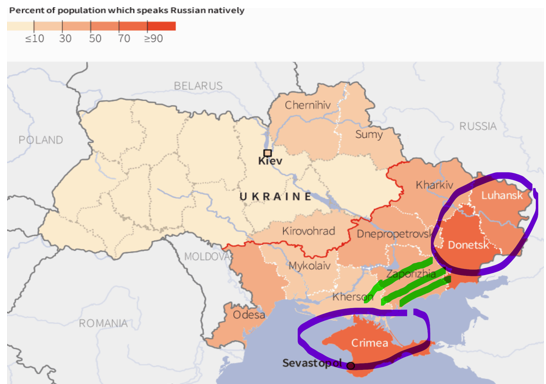

This map shows the parts of Ukraine which speak Russian (dark colour, more Russian spoken) and also the two areas of Crimea (annexed by Russia) and Donetsk/Luhansk (which have declared their independence from Ukraine), ringed in purple.

Between those two rings, the green lines, are where Russia might take (relatively) limited action to join those two areas, creating a corridor to Crimea. Limited action might take various forms, and this is just one possibility.

For Putin this would deal with his legacy. He won’t pee off the Russian elite (excuse the vernacular). The political and military hiatus might be relatively short-lived, over months, and stock markets might fall by no more than 30%.

Scenario 1: Limited Action By Russia

Scenario 2 is more worrying, and this is shown in the map below.

This is the kind of map you might have seen in the media, illustrating that Russia already has Ukraine surrounded. This doesn’t seem the most likely outcome to us because Putin will likely upset the hugely powerful Russian elite, the West is more likely to over-react with painful sanctions, and less likely to negotiate on softer matters e.g. where NATO is deployed.

This would also be more prolonged, and market falls of 50% and more can be expected, particularly once you factor in the other crises to which we now turn.

Scenario 2: Blitzkrieg, all out invasion

INFLATION CRISIS

In the 1970s there was an inflation shock. The oil price quadrupled in 1973 (Yom Kippur War), and in 1979 oil prices spiralled again (Iranian Revolution).

Inflation headed towards 20%, and new leadership was needed in the US central bank. Along came Paul Volcker.

- Interest rates were raised to 20%

- Severe recession followed

- 10% unemployment

- Inflation dropped sharply

- Debt crisis

There has not been a shock on this scale today. Everybody knew there would be some pandemic-impacts on inflation - that wasn’t a shock.

But now war may play the role of shock, in a somewhat more vulnerable environment than the 1970s:

- Global debt ratios now 3x greater.

- Stock markets massively more overvalued.

- If interest rates only rise a few percent, the impact could be disproportionately unpleasant.

A nasty chain reaction if war unfolds and inflation heads higher.

SUPPLY CHAIN CRISIS

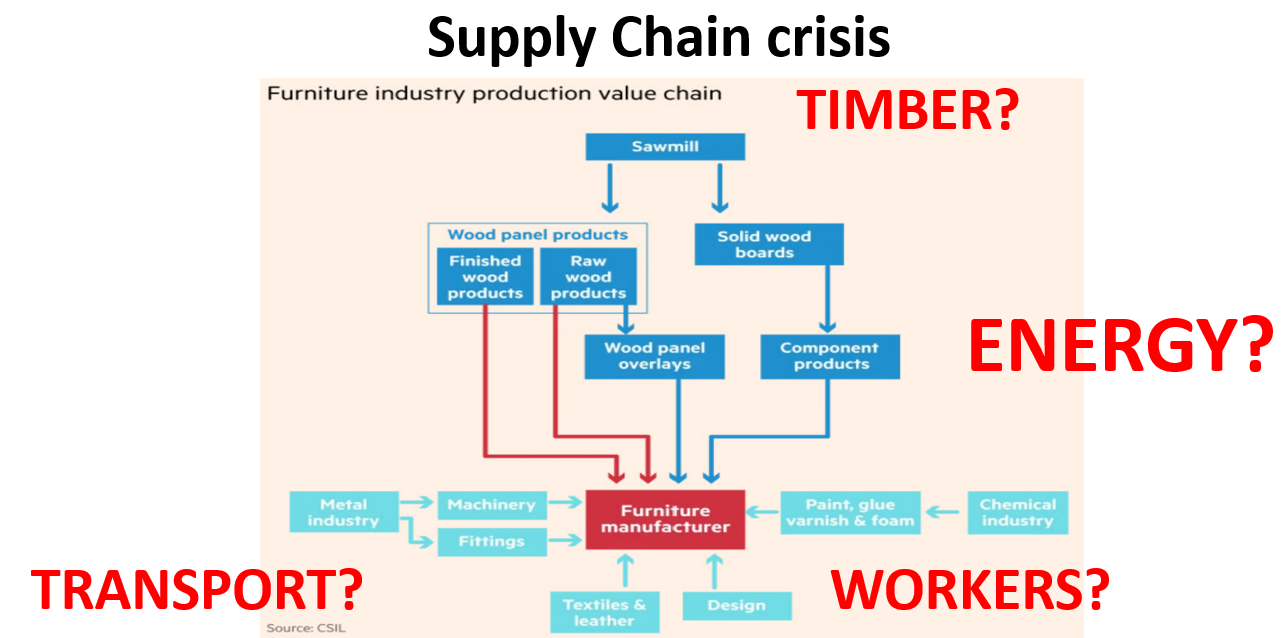

The FT recently published this chart, and we have added our own annotations.

Each of these different components to make a bit of furniture take place in different parts of the world. More fundamentally, you need to have access to timber. There needs to be sufficient energy. Transport needs to be uninterrupted. There needs to be enough workers.

At the very least war in Ukraine will certainly impact energy prices, but very possibly also energy supplies. Imagine these problems being encountered throughout Europe, amongst all industries.

ENERGY CRISIS

Since the 1990s, on ten occasions oil prices have risen by 50%+, that’s roughly once every 3 years.

In response, more investment/exploration will eventually reduce prices – but not today. Fossil fuel companies have been actively discouraged from further exploration.

Higher oil prices will spur green investment - but there is a long lead time.

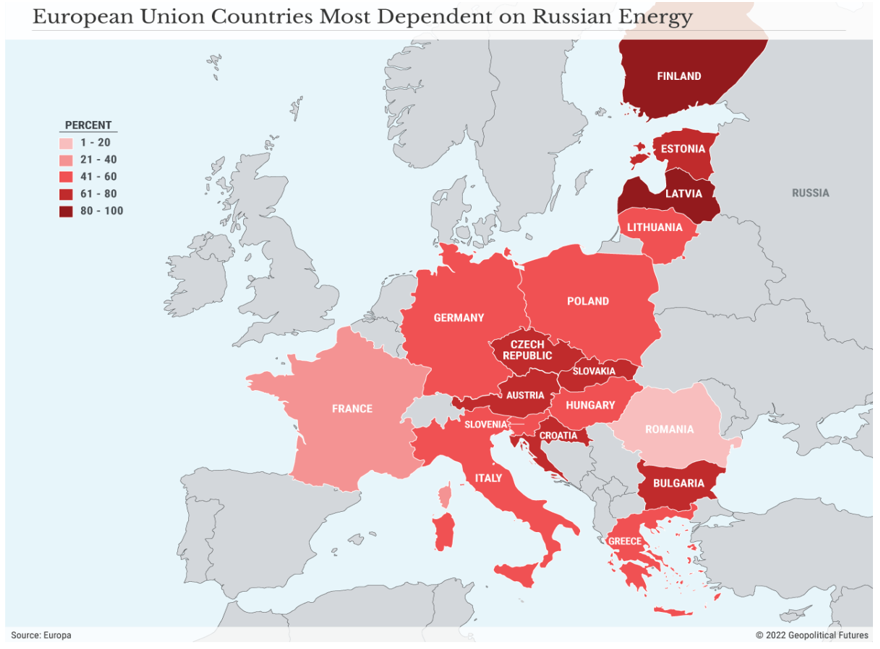

Europe is particularly exposed. One third of Europe’s gas comes from Russia. The map below breaks this down country by country, where dark red means a greater dependence on Russia.

Germany in particular is in a tough place, and Putin knows this:

- Europe already divided on reducing fossil fuels.

- 53% of coal from Russia.

- 50% of German homes rely on gas…

- …1/3 of that comes from Russia.

- Pandemic highlighted supply chain issues…

- …but re-basing depends on stable gas supply.

Sanctions against Russia? Only with considerable risks to Europe. Putin knows this too, which means that the window for his aggression is now.

Why? As the decade unfolds, supply constraints will resolve, and new energy supplies will emerge.

Putin has maximum leverage now.

Imagine his response to sanctions:

“Cut us off from world, we cut off your energy supply, and attack your financial markets”.

Don’t overlook the latter risk. Cyber attacks are highly likely, and this is a potent Russian weapon. Several large Ukrainian companies have already reported cyber attacks taking place, this is likely to grow in scale in the coming weeks.

It is early days. It is impossible to know what Putin has in mind. But on Monday evening (21st February) in his 50 minute incoherent ramble there was enough to make us more worried than we had been at lunchtime.

The markets response has been… very little. That is until today (24th February), when this morning Putin declared a “special military operation” in Ukraine, with reports of explosions across several major cities throughout the country including the capital, Kyiv.

Most European and Global markets are down in the region of 2% - 5% thus far, and this is bound to fall further.

Generally, markets are not very good at responding to more complex events, and right now all of the above cross-currents do make simple analysis impossible. However one thing is clear, markets are driven by investor confidence and sentiment to buy. Right now there is very little confidence throughout the world (there has generally been little confidence since the turn of the year), and the events unfolding in Eastern Europe could be the trigger point for sharp and drastic falls.

We feel more caution is needed heading into the next few weeks (and potentially months). It might be because we feel a bit frayed after two years of the pandemic. Perhaps. If you have any questions please do not hesitate to contact us directly, and do talk to your usual adviser if you would like a more in-depth discussion about your portfolio.

FURTHER READING