How is your investment portfolio like a garden? Never thought about it in those terms? Sometimes a different perspective helps to see the wood for the trees...

A beautiful but low maintenance garden might require little more than pruning and tidying twice a year.

A portfolio can also be low maintenance but high performance. We have illustrated many times that a simple process applied twice yearly for 30 minutes can hugely improve performance.

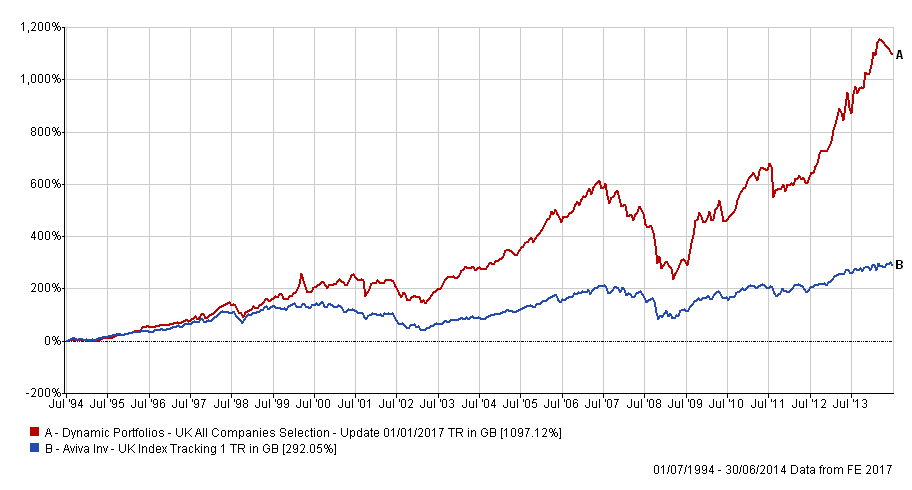

For example, using momentum to select wining funds every 6 months has boosted the performance of a UK growth funds portfolio by more than 6% per annum over the 20 years to 2014 compared to being invested in an index tracker. That’s life changing (chart 1).

Many will judge you by looking at your garden. What you might see as “interesting and wild”, others will see as a mess which needs a lot of money spent on it.

Similarly your investments. You might smile and call it eclectic – but the reality is that it has no structure and is hugely underperforming.

Choosing a bad gardener probably won’t ruin your life. Selecting a poor adviser, without the right skills for you, can irretrievably destroy your wealth.

Last but not least a great garden and a consistently outperforming portfolio have one thing in common – a thoughtful plan, consistently applied.

FURTHER READING

Chart 1: Momentum vs. an index tracker