One of the issues which will arise if there is a hard Brexit is sterling weakness, so I wanted to get ahead of events and see how this will impact you and your investments.

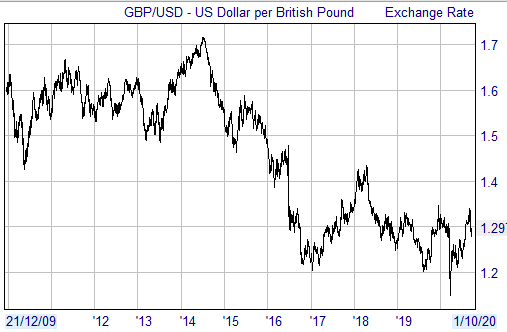

For context, here is Pound Sterling versus the US dollar over the last decade. A sideways movement for a number of years was broken in 2015/16 as the referendum loomed. Since then it has mostly been drifting sideways in a range of 1.20-1.40.

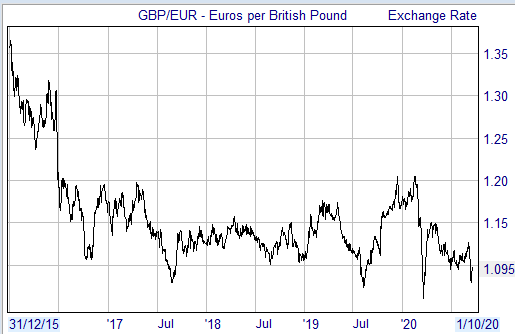

And here it is versus the euro since 2016, the year of the referendum. Again you can see the falls into the referendum, then a prolonged sideways movement for years, ranging mostly between 1.06 and 1.18.

As I look at the above chart it appears that the currency has had four years to take into account the very clear possibility of a hard Brexit, but Sterling has simply moved in that range of 1.06-1.18. Right now the risk of a hard Brexit is high, yet Sterling has just moved to the bottom of that range. The referendum result was a surprise, and the currency quickly adjusted; in contrast, a hard Brexit in the months ahead will not be a surprise.

Yet I must not be complacent as many factors feed into currency swings e.g. what if there was renewed UK political turmoil combined with a hard Brexit?

Similarly I recall the warnings of Alan Greenspan:

“Despite the extensive efforts on the part of analysts, to my knowledge, no model projecting directional movements in exchange rates is significantly superior to tossing a coin.”

Suitably chastened, let’s not try and figure if Sterling will weaken, rather look at what might be the consequences.

Losers

Prices of imported goods will increase, so consumers and businesses who buy imports will be worse off. That will include petrol, and a lot of food and electrical goods.

Companies which export to the UK will be less competitive in the UK.

Travelling abroad will be more expensive.

Foreign workers will find it less attractive to work in the UK.

UK pensioners who have retired abroad will suffer a fall in the value of their pension.

Winners

Some countries are of jealous of the UK and it’s relative weakness, because in a world of stubbornly slow growth, a weaker currency is one way of making your economy more competitive.

UK exporters can sell their goods more cheaply or increase their profit margins e.g. engineers or manufacturers.

A good number of companies quoted on the UK stock market have their earnings in dollars, such as the pharmaceutical companies or commodity companies, and/or do most of their business in the US. It is believed that three-quarters of the earnings of FTSE 100 companies come from outside the UK.

All of the latter does assume that there is sufficient demand from overseas – which in the short term might be stunted by both the pandemic and adjusting to WTO trade rules if there is a hard Brexit. Accepting this possibility, the weaker pound can give a lift to economic growth, boost confidence, and benefit the country as a whole.

Foreign tourists into the UK will increase, and foreign buyers of UK assets will get a boost. This can be properties, but also takeover activity amongst UK quoted companies, which overnight look even cheaper than they are already.

UK investors will also get a boost from investments in overseas funds, whether American, Asian or European. Our preferences would be Asian and European funds, as we have covered off over recent months.

Next week we will look at some specific funds to fit the above opportunities, and join this with uncovering UK funds with heavier weightings in obviously cyclical sectors, including construction (as raised in the teleconference yesterday).